Get Smarter About Real Estate Investing

240+ FREE ARTICLES

REI.School is your insider guide to building wealth through real estate. Whether you’re just getting started or growing your portfolio, we’ve got you covered.

Join us as we take a deep dive into real estate investing, where we break down the strategies you need to learn, build, and succeed.

Watch hundreds of videos on our YouTube Channel where experienced investors share strategies, and proven techniques to help you take your real estate investing to the next level, all under one roof.

Featured Video

A DAY IN MY LIFE AS A REAL ESTATE INVESTOR

Come take a 2-minute ride through a day in my life as a RE investor (Jonathan Mednick) managing our short term rentals, supply runs, wellness checks, and marketing a long term rental property.

Strategies

Should You Pursue a Rent to Own Strategy?

Rent-to-own offers a middle ground between renting and buying, allowing tenants to lease with an option to purchase later. While it can offer a path to homeownership, it carries risks for investors including market fluctuations, financing challenges, and fallout, requiring careful structure and thorough screening. Is this worth pursuing? Let’s explore.

February 16, 2026 | 4 Minute Read

Managing Rentals From Afar

Self-managing an out-of-state rental property can boost cash flow and provide greater control, but it increases demands, legal risk, and vacancy exposure. Investors must weigh saved management fees against time, stress, and scalability. Success depends on strong systems, reliable vendors, and treating remote land lording like a business.

February 16, 2026 | 4 Minute Read

When a $32B Real Estate Hedge Fund Calls Me

I was approached by a $32B real estate hedge fund to become their exclusive listing broker in Birmingham. While the opportunity comes with added costs and systems, it also provides early access to deals, off-market opportunities, and a strong acquisition funnel with significant commission and investment upside.

February 9, 2026 | 3 Minute Read

Why Real Estate Agents Avoid Investors

Many real estate agents avoid working with investors because investors compress commissions, kill deals based on numbers, move fast, submit low offers, and require specialized knowledge. The misalignment between agents’ commission-driven incentives and investors’ margin-driven strategies often leads to frustration, inefficiency, and strained professional relationships.

February 9, 2026 | 3 Minute Read

Build to Rent Isn’t a Trend. It’s the Next Phase

I’m positioning our portfolio to take advantage of the shift toward build-to-rent by developing single-family homes, duplexes, and larger communities on land we already own. Policy changes limiting institutional buyers, combined with improving market conditions, make this an attractive window for long-term rental growth.

February 2, 2026 | 6 Minute Read

My Strategy to Get Higher Rents with Section 8

I recently realized how many investors leave money on the table with Section 8 by failing to raise rents. With the right strategy—proper rent increases and selective turnover—Section 8 properties can generate higher cash flow, stronger refinancing options, and long-term stability. Here’s how I do it.

January 26, 2026 | 3.5 Minute Read

The BRRRR vs. Turnkey Strategies

I’ve sold both turnkey rentals and BRRRR deals, and the difference is clear. Turnkey buys convenience and stability, but ties up capital. BRRRR takes more work, yet creates forced equity, stronger cash flow, and allows you to recycle the same money. However, the strategy you choose depends on one specific criteria. Read on.

January 19, 2026 | 2.5 Minute Read

How One Rehab Mistake Can Threaten Your Net Worth

Renovation risk isn’t about property size—it’s about exposure. Even small real estate projects can trigger costly lawsuits that threaten your personal assets. This article breaks down the hidden legal risks of value-add investing and explains why using an LLC is one of the smartest protections investors can put in place.

January 5, 2026 | 4 Minute Read

The Borrow Until You Die Strategy

There is a financial system quietly operating behind the scenes of everyday life. It’s an unspoken operating system—deeply understood by the wealthy, used daily, and almost never taught to the average person. Most people were never meant to see it. But once you do—once you truly understand how it works—you can’t unsee it. I am going to show you the owner’s playbook—the system that allows wealth to grow, compound, and survive for generations.

December 29, 2025 | 3.5 Minute Read

Analysis

A Big Capital Gains Shift for Investors

A Big Capital Gains Shift for Investors

Proposed changes to capital gains tax rules could unlock trillions in home equity by raising or eliminating outdated exclusion limits. For real estate investors, this shift may create rare opportunities to sell tax-free, increase housing supply, and redeploy capital into rentals, renovations, or debt reduction.

February 2, 2026 | 3.5 Minute Read

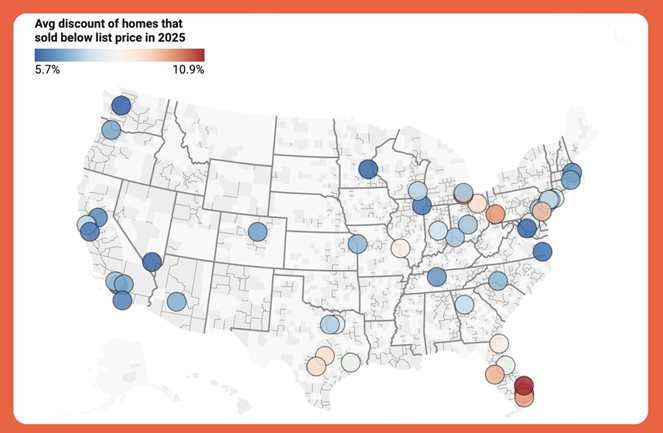

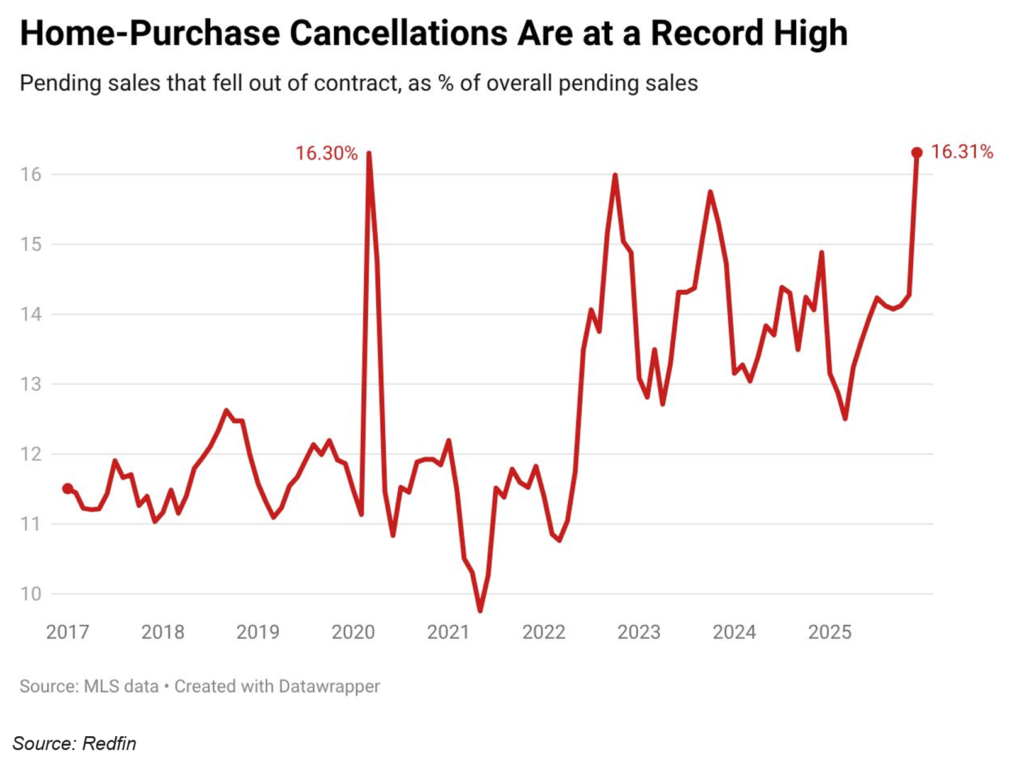

The Housing Market Has Flipped… to Buyers

The Housing Market Has Flipped… to Buyers

I’m seeing the clearest buyer’s market we’ve had in over a decade, driven not by excess supply but by falling buyer demand. With more sellers than buyers, leverage has shifted. For qualified buyers, this creates rare negotiating power, while sellers must price realistically to compete or risk longer days on market or worst, not selling.

January 26, 2026 | 1.5 Minute Read

We Added Another Short Term Rental After Downsizing

We Added Another Short Term Rental After Downsizing

Over four years of operating short-term rentals, I learned that success comes from systems, not scale. After growing to 18 units and intentionally downsizing to 8, we refined our processes, analyzed the data, and built operational confidence, making it the right time to add another short-term rental to our portfolio.

January 19, 2026 | 2.5 Minute Read

How We Turned Five Rentals Into a Six Figure Profit Machine

How We Turned Five Rentals Into a Six Figure Profit Machine

Every profitable real estate deal starts—and ends—with two numbers: As-Is Value and After-Repair Value (ARV). If you don’t understand the difference between them, you’re not investing. You’re gambling. These two values determine what you should pay, how much you can borrow, and whether a deal makes sense at all. Let’s break them down.

January 12, 2026 | 3.5 Minute Read

The Numbers That Make or Break Every Real Estate Deal

The Numbers That Make or Break Every Real Estate Deal

Every profitable real estate deal starts—and ends—with two numbers: As-Is Value and After-Repair Value (ARV). If you don’t understand the difference between them, you’re not investing. You’re gambling. These two values determine what you should pay, how much you can borrow, and whether a deal makes sense at all. Let’s break them down.

January 12, 2026 | 2.5 Minute Read

Two Section 8 Rentals → Airbnb’s = $95,000

Two Section 8 Rentals → Airbnb’s = $95,000

I break down how my two former Section 8 properties performed as short-term rentals in 2025. I share real numbers, occupancy data, and lessons learned, showing how necessity-based rentals and mid-term stays helped me increase net income more than sixfold.

January 6, 2026 | 3 Minute Read

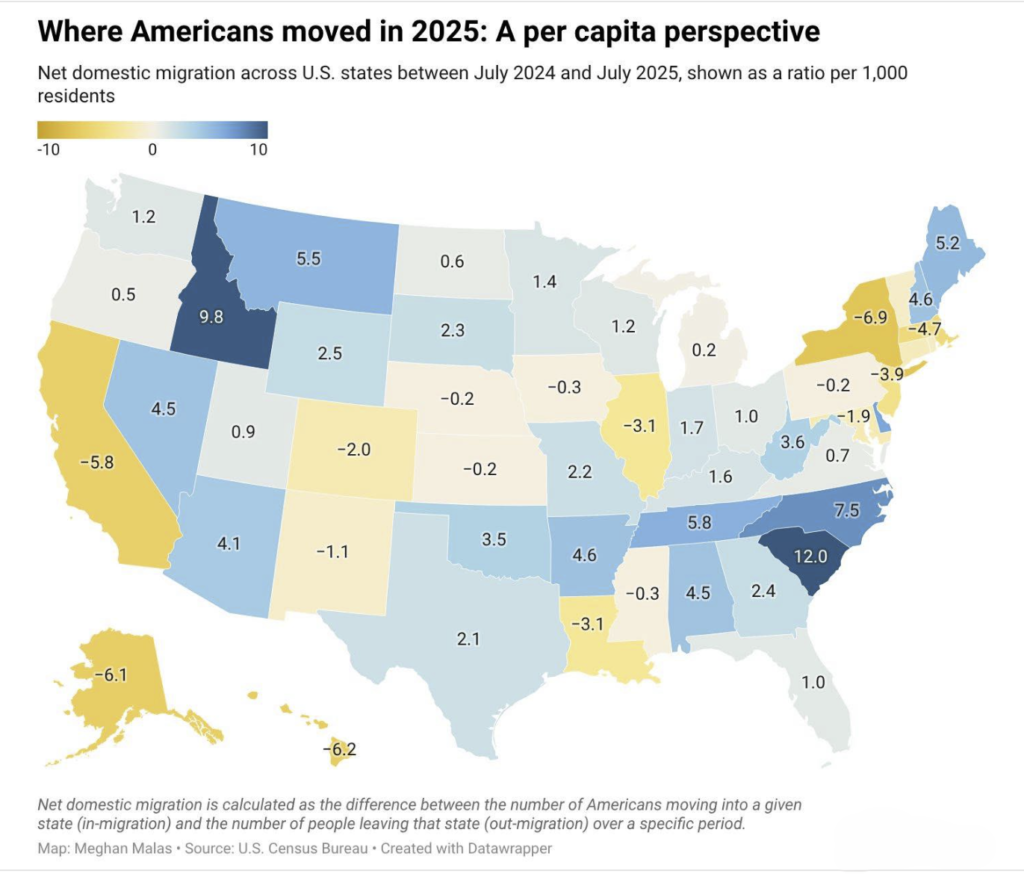

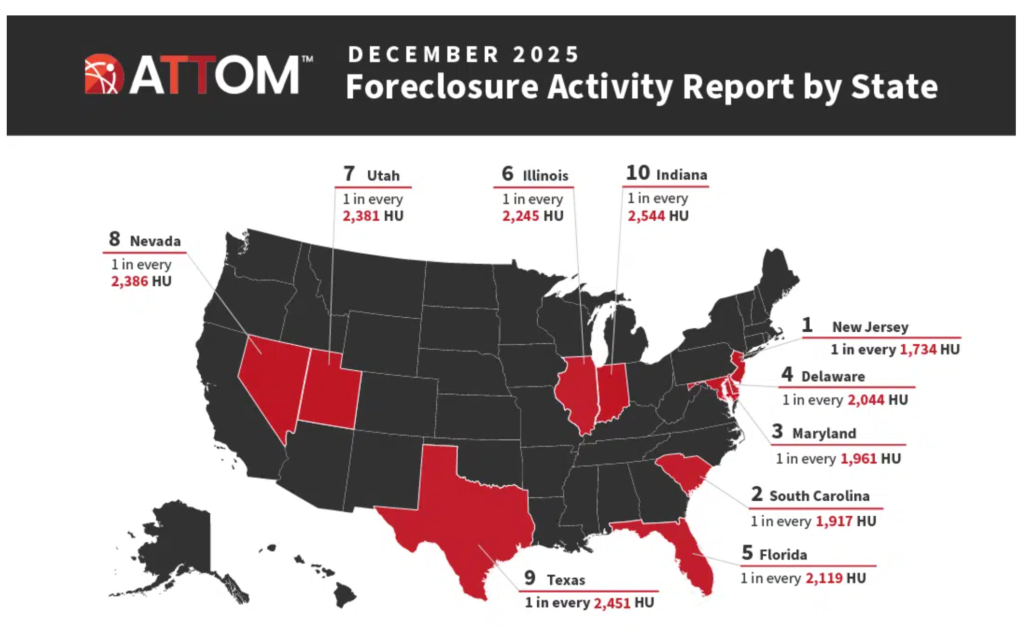

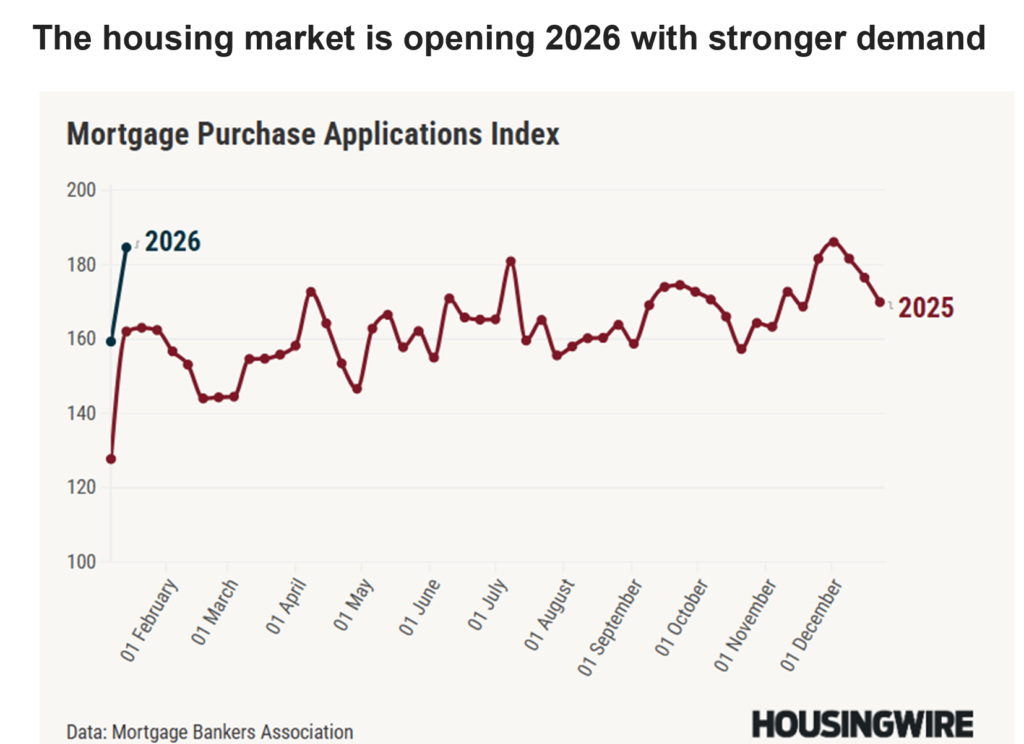

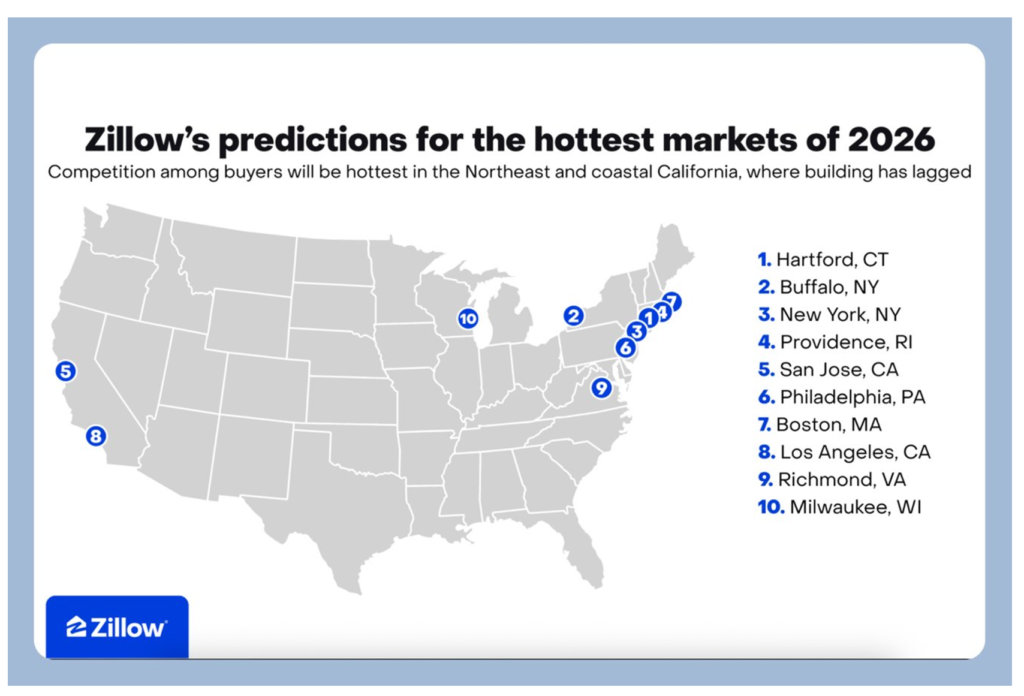

My Seven Housing Market Predictions for 2026

My Seven Housing Market Predictions for 2026

As we look ahead to 2026, one thing is clear: the housing market is stabilizing, not resetting. Rates are higher than the ultra-low levels of the past, inventory is gradually improving, and buyers and sellers are adjusting expectations accordingly. Here’s a breakdown of the seven most important trends I believe will shape the housing market next year.

December 29, 2025 | 3.5 Minute Read

How Local Real Estate Investors Can Beat Institutional Buyers

How Local Real Estate Investors Can Beat Institutional Buyers

As corporate investors expand their presence in housing, small real estate investors gain a clear advantage. I explain how local ownership, flexibility, and responsible management can enable you to outperform institutional landlords while supporting communities and building long-term, sustainable wealth.

December 22, 2025 | 2.5 Minute Read

How To Build Massive Wealth With One Rental Property

How To Build Massive Wealth With One Rental Property

Discover how real wealth is built through rental properties using appreciation, debt paydown, tax strategies, and smart leverage—not just cash flow. Learn the four wealth-building forces the rich use and how one rental can explode your long-term net worth.

December 8, 2025 | 4 Minute Read

Investors Board