June 30, 2025 | 2 Minute Read

While browsing the MLS, I found a property listed for $57,500. I contacted the agent—only to learn it was actually a wholesaler, who failed to disclose “seller holds equitable interest.” That’s a required disclosure when marketing a contract on the MLS.

Still, I scheduled a showing. The home was a 3 bed, 2 bath, 1,600 sq. ft. with a 2-car garage. It needed about $60K in renovations for a retail flip, including full mechanicals (roof, HVAC, plumbing, electrical). The rest would go toward cosmetic updates like kitchen, baths, paint, and finishes.

ARV & FLIP PRO FORMA

Comps ranged from $152K to $209K but market softening led me to conservatively peg the ARV at $190,000.

Purchase:

Purchase: $57,500

Closing: $1,150

Renovations: $60,000

Contingency: $6,000

Holding: $2,700

Lender Fees: $10,582 (6 months hold at 12%)

Total: $137,932

Sale:

ARV: $190,000

Less: $5,000 seller concessions

$9,500 agent commissions

$2,000 closing

Net Profit: $35,568 (~26% ROI)

RENTAL EXIT STRATEGY

If I held it:

Reduced reno budget: $50,000 (rent ready renovation)

Total investment: $121,932

Rent: $1,600/month

Cap rate: 12.73%

Cash flow: $396/month

DSCR: 1.57

Numbers looked solid for both a flip and a hold.

THEN CAME THE SWITCH…

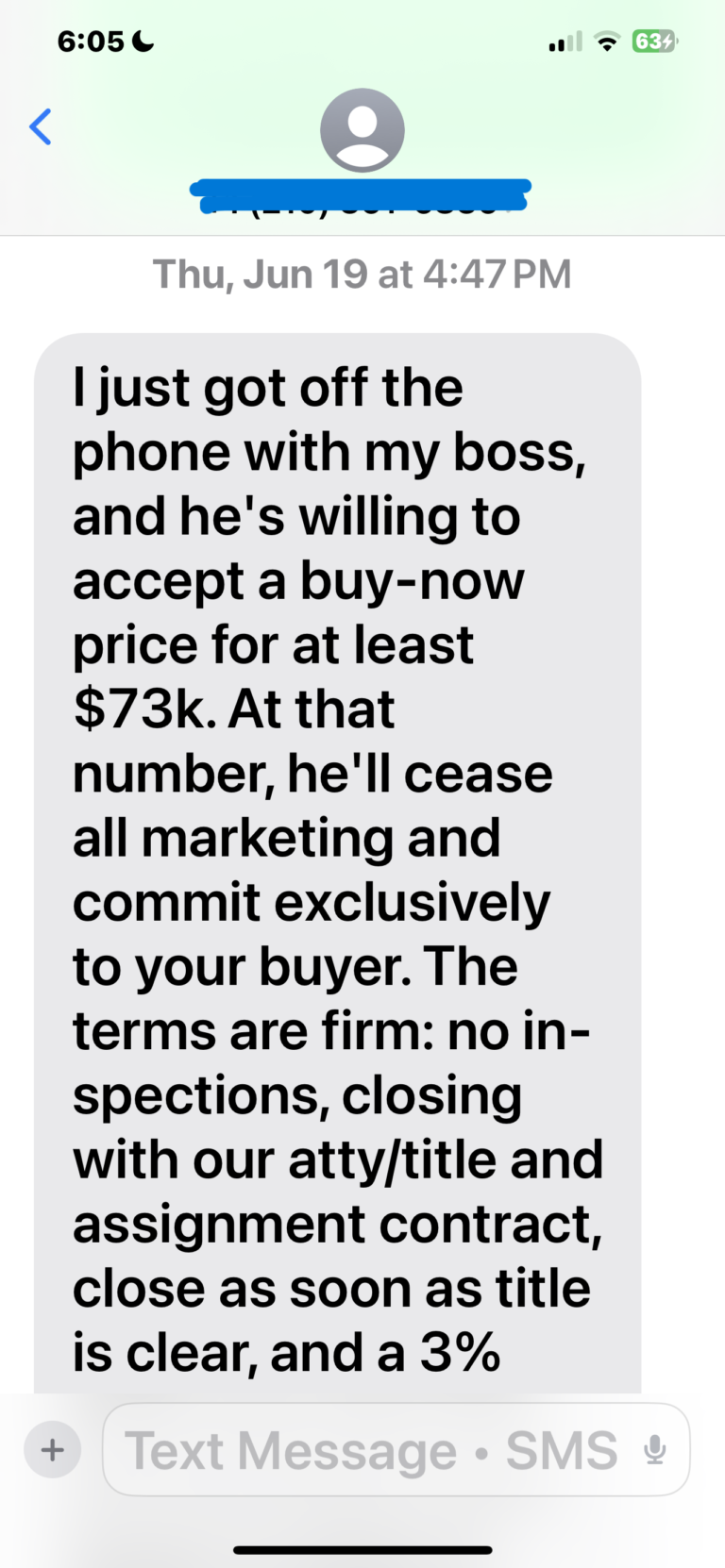

I called the wholesaler and said I was ready to close—cash in 14 days. He said he needed to check with his manager. A few hours later, he sends me the following text:

“Buy now for $73,000”

That’s a $15,500 price hike—a sneaky tactic wholesalers are using more often: list cheap to draw interest, then raise the price when buyers are serious.

At $73,000, my projected profit drops to $20,000 and ROI to 14.5%.

Then I checked the active comps:

-

10 listings

-

73 average DOM

-

$5K–$20K price cuts

If I only got $180K on the resale, I’d net $10K (7% ROI). Too thin for the risk.

Even as a rental, cash flow would drop to $357/month and DSCR to 1.38—tight margins but still doable as a rental. However, I need two viable exit strategies to agree to a purchase and with the new price, I have only one.

Now, I do not care what the wholesaler makes on the deal. The last closing I had a week ago, the wholesaler netted $20,000. What irks me is the deceptive way this wholesaler presented the property and then jacked up the price and made it seem like he was doing me a favor by giving it to me exclusively.

So, I pass on the deal.

A few days later, I saw the property went pending.

I wouldn’t be surprised if a newer investor ended up buying it for $73,000. If so, it’ll be interesting to see how their deal turns out. If they re-list for sale, I’ll revisit the property and write a follow-up post to compare their results with my original projections.