June 17, 2024 | 4 Minute Read

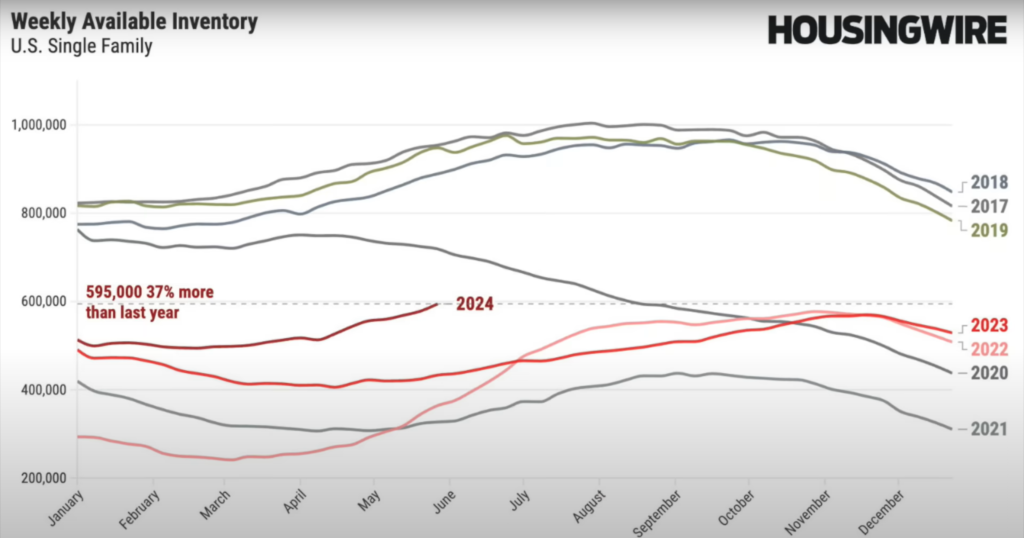

We are finally seeing signs of panic in the real estate market following the release of new data from various reliable sources. The main concern for many right now is the rapid growth in inventory. Experts who have accurately predicted market trends since 2020 agree: regardless of how high prices get, they can be explained by the simple lack of supply.

Since 2020, the residential real estate inventory has been extremely tight, with very few homes available. Every open house was crowded, and offers poured in from all directions, leading to one of the fastest price increases in American real estate history. However, fresh data suggests we may be witnessing a sudden, concerning change that could transform the real estate environment forever.

To understand the situation, we need to explain the complexities of real estate supply statistics. It’s initially confusing, but with a simple background description, it becomes clearer. First off, various sources provide data regarding supply, each with its flaws, lags, and differences in methodology, making understanding this data more difficult than a simple glance at a chart. Additionally, raw numbers can be misleading. For example, according to realtor.com, there were about 1.2 million homes for sale in the U.S. in May 2017. Today, that number is around 800,000, which might suggest a 33% tighter market than in 2017. However, this doesn’t account for the number of sales.

A better metric to understand inventory is the “months of supply.” This crucial metric divides the number of homes actively for sale by the average number of monthly buyers, truly indicating how good or bad the inventory situation is. If sales continue to follow 2023 numbers, the number of homes listed would need to increase by about 20% to around 880,000 for months of supply to return to 2019 levels by July. Once this happens, we can start talking about a potential collapse in prices across the United States.

Currently, the panic is mostly concentrated in pandemic boom regions like Texas and Florida. Even major real estate CEOs are acknowledging this shift. Compass CEO Robert Reffkin mentioned during a live appearance on CNBC that there are now more sellers than buyers. For instance, in May, there were more price drops than at any time in the last ten years, reflecting buyers pushing back on the upper limits of affordability. Reffkin noted that more inventory has come on the market, particularly in the million-dollar-plus home market, with buyers pushing back and record price drops occurring.

The inventory picture is changing daily in some regions, making a turn for the worse. For example, in Nashville, active inventory increased by 12% from April to May and 23% compared to the same date last year. Interest rates, the stock market, and unemployment rates have remained relatively stable since 2023, prompting questions about whether buyer demand is drying up or more sellers are looking to capitalize on their equity gains. Prices in Nashville aren’t dropping; in fact, they are rising. This imbalance between rising inventory and rising prices is concerning experts and causing them to reevaluate the situation. If this kind of inventory growth continues, the foundation for high prices could slip away, leading to a more turbulent market.

Before predicting a crash, it’s essential to look at the national picture. National statistics indicate we are still some time away from a significant downturn. The months of supply are still below six months, making it unlikely for national price declines to occur. Even at six months of supply, it wouldn’t be considered a seriously dangerous number. For a downturn to happen, we would need to see a continued trend of inventory buildup. Reaching pre-pandemic months of supply figures nationally is possible this year, which would then warrant concern for the future.

Most areas of the country still see higher prices and slightly rising inventory levels, staying below 2019 peaks. However, in pandemic boom areas like Texas, Florida, and Nashville, the inventory situation is worsening. These local markets will act as indicators for the rest of the country. If massive inventory growth spreads to other areas, we could see a crash. Otherwise, it’s simply speculation. Inventory is the basis for the entire residential market, and without surpassing 2019 highs, a crash remains unlikely.