November 25, 2024 | 2.5 Minute Read

In the early days of wholesaling, before the internet and modern tech tools revolutionized the industry, the primary way to find cash buyers was through networking at local real estate investor meetups. Collecting business cards and building an email list was key.

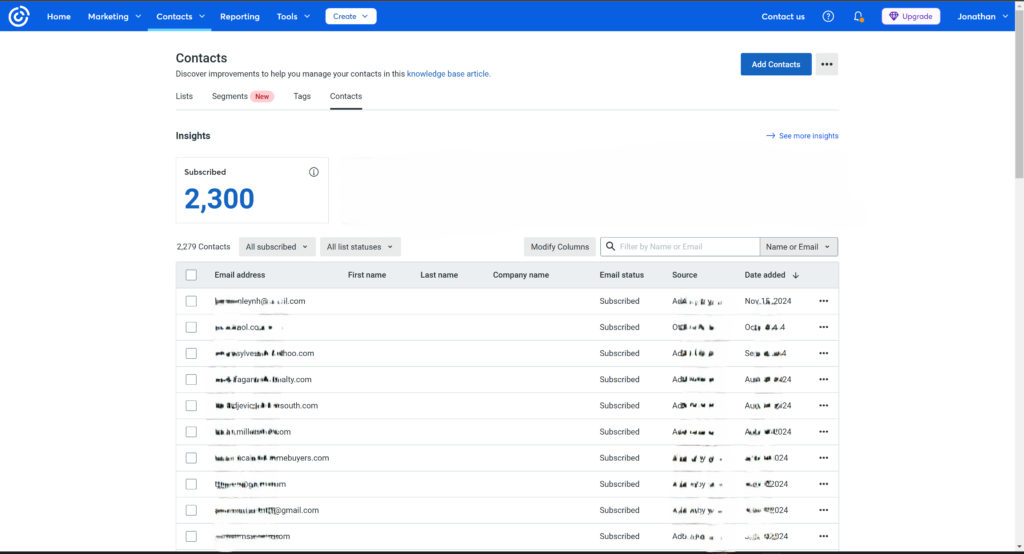

That email list was like gold—a tightly guarded resource. It became my entire marketing strategy for promoting wholesale properties. At present, my email list stands at 2,300.

While that might sound like a lot, the truth is, no matter how large the list, all I need is one buyer for that one property.

When I email out a deal, the response can range from a few inquiries to dozens of calls or emails, depending on the property. Most of the time, I’ve been successful in selling properties this way. But what about those times when I send out a property and hear nothing but crickets?

Does it mean I misjudged the property’s potential, asking price, comps, ARV, or repair costs? Maybe—or maybe not. It’s often too subjective to pinpoint. Timing could also play a role—factors like the season, interest rates, or broader economic trends can influence buyer interest.

Every investor has their own perspective on the market, preferred exit strategies, and individual risk-reward thresholds. What works for one may not appeal to another, and understanding these nuances is key to staying successful in wholesaling.

Today, the landscape for marketing wholesale properties has evolved significantly. With advancements in technology and the proliferation of online platforms, wholesalers have a wide array of tools and strategies to promote their deals. The options have expanded far beyond the traditional methods, making it easier than ever to reach potential buyers.

Let’s quickly review some of the some of these approaches before I share my secret sauce for finding those elusive repeat buyers—the ones purchasing under a corporate entity.

Facebook Groups & Real Estate Forums: Join local and national groups dedicated to investment properties. These communities are great for sharing deals and networking.

LinkedIn Outreach: Use LinkedIn to connect with corporate investors, asset managers, and acquisition specialists.

Real Estate Investment Platforms: List properties on platforms like Crexi, LoopNet, or Ten-X, which cater to institutional and corporate buyers.

List-Building Software: Tools like PropStream, BatchLeads, or InvestorLift can identify corporate buyers actively acquiring properties in your area.

Google Searches: Search “We Buy Houses” in your city. The top results often include active local investors and wholesalers. Reach out to discuss potential joint ventures.

Lenders & Title Companies: Partner with hard money lenders and title companies. They often work with corporate buyers and can connect you with active clients.

Many of these strategies rely on publicly available contact information or attract buyers who will provide their details when interested.

When time is running out and your inspection deadline looms, this is where experienced wholesalers separate themselves from the rookies. After posting the property online, don’t just wait—take steps to elevate your game.

In a previous article, “How to Find Active Buyers on Zillow”, I discussed using Zillow, the County Assessor’s website, and skip tracing services to locate buyer contact information. These methods work well for individual buyers, but corporate entities require a different approach.

Let’s Review:

Use MLS or Zillow: Search for all properties purchased by cash buyers within a 1-mile radius of your wholesale property over the past six months.

Export & Categorize: Export the data and separate individuals from corporate buyer names.

Skip Trace Individuals: Skip trace the individual buyers to contact directly.

The Secret Sauce for Corporate Buyers

Finding contact information for corporate buyers can be tricky, but here’s how I do it:

County Tax Assessor’s Website: Search for the corporate name to view transactions. With multiple results, chances are they are pretty active buying and selling.

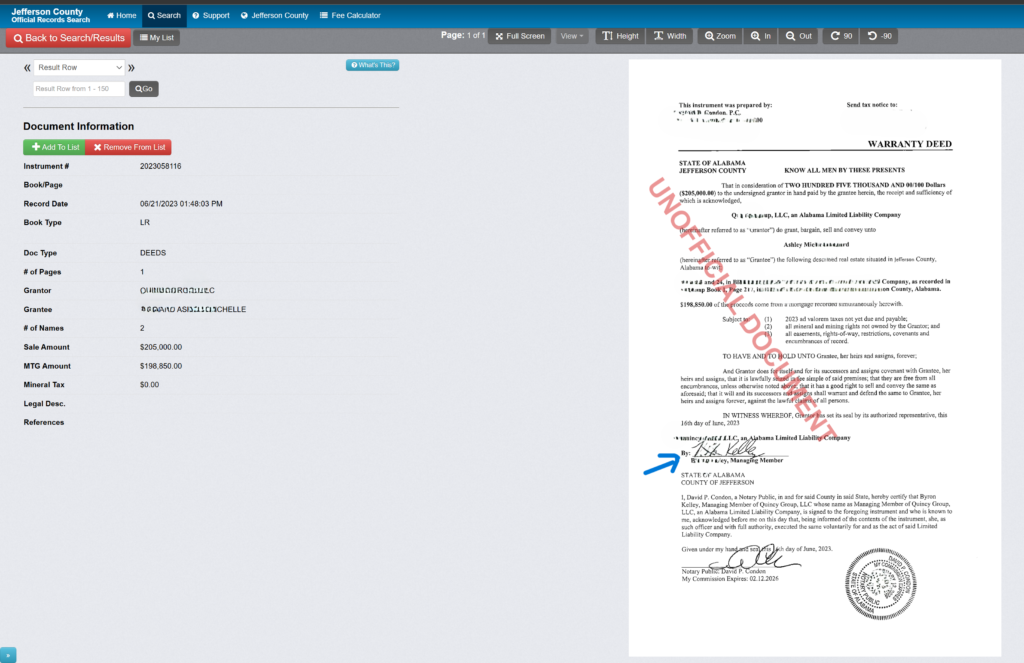

County Official Records Search: Every county readily has publicly available recorded documents online. Find their website, enter and search the corporate name to view recorded documents such as deeds and mortgages.

View Documents: Review the deed for the name of the individual signing on behalf of the corporation and the title company (see below example).

Skip Trace: Skip trace the individual for contact information.

Search Social Media: Use the individual’s name and corporate name to search on platforms like LinkedIn and Facebook.

Contact Title Company: Call the title company listed on the deed to request contact information for the corporate buyer’s representative.

Once you have the contact info, call, text or email your property details. Even if they’re not interested, you’ve added another buyer to your email list.

This approach works about 80% of the time in my experience. It takes effort, but the payoff is worth it. And, if you want the most detailed and comprehensive assignment agreement I have been using for more than 20 years, you can find it here.