February 17, 2025 | 3.5 Minute Read

I’m actively searching for turnkey rental properties to buy, and what better way to find opportunities than through Facebook investor groups? Right?

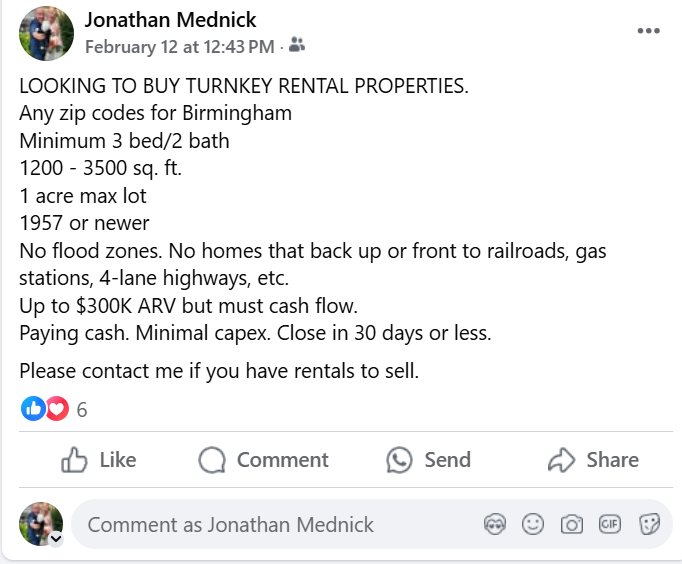

I placed this post on my page and in all the relevant Birmingham investor groups.

The response was decent—plenty of direct messages, texts, calls, emails from owners, wholesalers and real estate agents—but most of the properties weren’t turnkey, tenant-occupied, required renovations, or even close to meeting my purchasing criteria.

Every week, I get calls from wholesalers wanting to add me to their buyer’s list. The conversation always starts the same way:

“What is your buying criteria?”

Yet, ironically, most who responded to my post completely ignored my buying criteria. I try to be polite and responsive, but my patience has limits. Here’s one of the email interactions I had with a wholesaler who responded:

The Conversation That Went Nowhere

👤 Wholesaler (WH): “Thank you for reaching out! I’d love to learn the specifics of what it is you’re looking for so I can get dialed in to the specific properties that you like. What is your ideal buy box?

🤨 Me: “I posted it on Facebook and already emailed it to you.

🚨 Red Flag #1: Did he even read my post? This shows a lack of detail on his part.

👤 Wholesaler (WH): “Yes. I saw your post in the investor group! I’d love to help you find properties that match your criteria. Here’s one in Midfield: 3 bed, 2 bath, 1,805 sq. ft. It’s ready to go now! The property is listed at $175K, but I can get you in at $170K. I’m also the listing agent and can represent you on the purchase.”

🤨 Me: “We require turnkey properties. Are you planning to place tenants? If not, your pricing is retail, not wholesale.”

👤 WH: “We own and renovate these properties, so yes, we’re looking to sell closer to market value.”

🚨 Red Flag #2: His pricing is at above market value but pitching it as an “investment deal,” and offered it $10K less to show how great of a deal it is. It’s also not tenant occupied.

🤨 Me: “We don’t buy retail. If you have actual turnkey rentals or wholesale opportunities, email them to me.”

👤 WH: “I believe this home is renovated and needs little capex, which puts it in the higher offer category.”

🚨 Red Flag #3: Renovated but needs a little capex? If fully renovated, none should be required.

🤨 Me: “You just sent me the same Midfield property. At $170K, it won’t cash flow.”

👤 WH: “I can get it to you for $160K.”

🤨 Me: “Still doesn’t cash flow.”

🚨 Red Flag #4: He again sends the same property, drops the price another $5K, ignores my concerns about cash flow, and still offering above retail pricing.

📉 The conversation ended there.

Breaking Down Why This Wasn’t a Deal

This wholesaler tried to pass off an above retail-priced property as a great investment opportunity. Here’s why it fell apart:

1️⃣ The Pricing Didn’t Make Sense

I ran comps (I’m a real estate broker) and found a contingent sale at $175K —but it was a larger (1,738 sq. ft.), 4-bed/3-bath home with a one car garage and a 2-car carport. The wholesaler’s property? Smaller, three bedrooms 1.5 baths, and no garage.

Active Sales – Green (This includes inspection and financing contingencies)

Pending Sales – Purple (All contingencies removed)

Closed Sales – Blue

When determining values, we only use closed sales. More realistic sold comps that were are in the $100K – $125K range so a fully renovated property may appraise at $145K. Any higher would be a stretch for the property offered.

2️⃣ The Property Wouldn’t Cash Flow

I always buy for cash, perform some repairs, and place the tenant using the BRRRR strategy. Here’s the numbers when refinancing:

Rents in this area average: $1,150/month

Financing scenario: 75% DSCR loan, 30-year fixed, 7.5% interest

At $160K purchase price:

Cash flow: $111/month

DSCR: 1.13 (below lender 1.2 minimum)

At a realistic $145K purchase price:

Cash flow: $190/month

DSCR: 1.25

3️⃣ Misleading Property Details

He overpriced the property using renovations to justify his “higher offer category,” basing his valuation on a single, irrelevant contingent comparable.

At his asking price, the deal barely cash flows and doesn’t meet a lender’s minimum refinance requirements.

He sees dropping the price from $175,000 to $160,000 as a great deal, despite still selling at above “market value,” even after I made it clear I don’t buy retail.

He misled me claiming the property had two bathrooms (a requirement of mine) when it actually has only one and a half.

Lessons Learned (Again!)

✅ Use relevant comps

Investors don’t fall for inflated prices based on one outlier contingent comp. While looking at actives to get a sense of the local area, only solid sold comps are to be used.

Most experienced investors will drop the highest and lowest comps and look for averages to be realistic about the projected ARV. Newer, aggressive and less experienced investors may accept that one high comp but do so at their peril.

✅ Understand financing

Just because a property is renovated doesn’t mean it will cash flow or meets the lenders minimum requirements.

You need to ask the buyer what is their ultimate exit strategy for the property. Ask buyers if they are using the BRRRR strategy. This will help you price the property to ensure adequate cash flow.

Don’t assume the buyer is tying up his cash indefinitely with the purchase. Most will refinance and re-capitalize their funds (BRRRR). This means additional closing costs for not only the refinance, but the purchase as well.

✅ Don’t mislead on details

Don’t mislead on property specifics. The truth will come out during further research, due diligence, and inspection.

Would I work with this wholesaler? No.

There are plenty of competent wholesalers who understand pricing, cash flow, and investor needs. Those are the ones worth building relationships with.