March 10, 2025 | 3 Minute Read

I’m actively seeking to purchase properties, and when I submit offers, my terms are simple: all-cash, as-is condition, and close within 30 days or less using my title company. In the past two weeks, I’ve secured seven properties under contract. Once we get past inspections and closing escrow, it’s time to fund these deals.

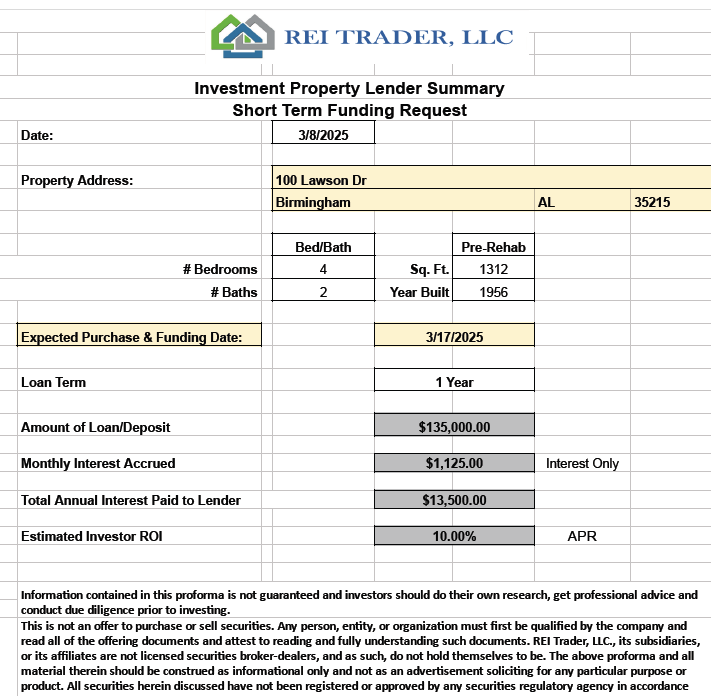

TIP: Read on to view a pro forma for an available loan to fund below.

But wait — didn’t I tell the sellers I was buying with cash? Yes, I did. However, I didn’t mean my own cash. Instead, I use OPM (Other People’s Money), otherwise known as private lenders.

I rarely use hard money lenders or institutional financing any more because they are time-consuming, requiring appraisals and underwriting approval. If renovation funds are needed, the money is escrowed, and the process includes inspections at each milestone before funds are released possibly causing delays in project completion.

Private lenders, on the other hand, don’t require us to jump through these hoops. These are individuals with whom we’ve built relationships over time, and they prefer to loan funds on our projects rather than manage rental properties themselves.

Benefits:

High Returns – Private lenders typically charge interest rates between 8-10%, much higher than traditional banks, offering strong returns.

Passive Income – Once the loan is funded, private lenders earn interest without needing to actively manage properties. This creates a passive income stream in addition to their regular earnings.

Tax-Free Income – Private lenders can even maximize returns by using IRA/401(k) retirement accounts to earn tax-free income.

Collateral Protection – The loan is secured by real estate, so if the borrower defaults, the private lender can take ownership of the property at a significant discount.

Short Loan Terms – Private loans generally last 4-24 months, providing quick returns and flexibility in reallocating capital.

Diversification – Lending allows the private lender to invest in real estate without the responsibilities of property ownership, adding an additional asset class to their portfolio.

Maintain A Current Job – A private lender does not have to dedicate time and resources to owning properties.

Disadvantages:

Risk of Default – If a borrower defaults, the private lender may need to foreclose on the property, which can be costly and time-consuming.

Illiquidity – Unlike stocks or bonds, the money is tied up in the loan until it’s repaid or refinanced.

Market Fluctuations – A downturn in real estate values could reduce the property’s worth, making it harder to recover a private lender’s capital if the borrower defaults.

Due Diligence – It’s essential to vet the borrower, the property, and the exit strategy to ensure the loan is sound.

Borrower Inexperience – Some investors, especially new ones, may mismanage the rehab or project timeline, leading to delays or cost overruns that could affect loan repayment.

If you’re considering becoming a private lender, it’s crucial to determine the experience level of the investor you’re funding. Make sure to verify their repayment track record by speaking with their title company about previous closings.

We’ve been using private lenders for over 10 years and have completed hundreds of loans. Have we ever been late on a payment or defaulted on a loan? Absolutely not. Our proven track record and strong relationships with our lenders ensure we stay well-funded while they all generate a healthy ROI.

How It Works:

We send out a request for funding to our private lender network, outlining the loan details and terms in a pro forma.

If the loan is of interest, private lenders respond with questions or confirmation to fund.

Our loans are highly attractive and in high demand, so we operate on a first-come, first-served basis.

PRO FORMA REQUEST TO FUND

Here is a pro forma of an available loan to fund as of March 10, 2025.

As a Private Lender:

Your loan will be in the first lien position at closing on the property listed above.

A mortgage and promissory note will be recorded by the title company securing your interest in this property.

You’ll receive a lender’s title policy.

You’ll be added as an additional insured on the homeowner’s insurance policy.

Upon loan satisfaction, you are the first to be repaid with your principal and accrued interest wired to your account by the title company.

If your interested in joining our private lender network, funding 100 Lawson Dr, or any other available loan we have to offer, please contact the guru@rei.school