November 24, 2025 | 3 Minute Read

Negative equity isn’t just a financial metric. It changes behavior. When homeowners owe more than their property is worth, they often make irrational decisions—sometimes life-altering ones.

According to recent Zillow data, 53% of homes in the U.S. have lost equity in the last year. That doesn’t mean more than half the country is underwater, but it does mean a huge share of homeowners are sliding in the wrong direction. And when someone dips into negative equity—even by a little—the risk of foreclosure skyrockets, even if they can still afford the monthly payment.

I know firsthand how irrational this can get.

Back in 2008, when I was investing in the Miami–Fort Lauderdale market, I saw homeowners let their properties go into foreclosure simply because they were about 30% underwater. They still had steady jobs. They could afford the payments. But the moment they owed more than the home was worth, they walked away anyway.

A foreclosure sticks with you for seven years. Yet people still do it.

The same pattern shows up with cars. When someone trades in a vehicle with negative equity, the chance of a future repossession doubles. Debt changes how people think.

The Next Wave of Negative Equity Homeowners

Builders are quietly creating the next wave of negative equity homeowners. Take Lennar, for example. They’re offering $64,000 in incentives on certain homes right now.

Sounds like a deal? But here’s the real story:

Instead of lowering the price by $64,000, they’re keeping the asking price artificially high and using incentives to make the numbers look attractive. Buyers feel like they’re getting a bargain—but they’re actually paying far more than the home is worth in today’s market.

That means many new construction buyers are now stuck owning houses they can’t sell without taking a loss. They’re trapped, and most don’t even realize it yet.

And here’s the thing:

Negative equity doesn’t become a crisis until life happens.

What if:

They lose their job?

They get sick and can’t work?

They go through a divorce?

They get transferred for work?

They have a death in the family?

That’s why equity matters. If life goes smoothly, underwater owners can wait it out.

But not everyone gets that luxury.

An Opportunity for Real Estate Investors

Where homeowners see stress, investors see opportunity—provided they approach it ethically and intelligently.

Here’s how smart investors benefit in a negative-equity environment:

1. More Motivated Sellers

Homeowners who are underwater often can’t sell traditionally.

That makes creative solutions—subject-to, seller financing, wraps, novation’s—far more appealing.

2. Increased Distress = Increased Deal Flow

As negative equity grows, so does:

Pre-foreclosure inventory

Short-sale opportunities

Off-market leads from homeowners desperate for options

This is where investors who specialize in solving problems thrive.

3. New Construction Buyers Will Need Exit Strategies

All those buyers who paid inflated prices due to builder incentives?

They’ll need help when life forces their hand.

Investors who build relationships with these homeowners early can secure deals before they hit the market.

4. Portfolio Buyers Win Big

With equity compressing nationally, investors who buy at discounts—or who buy creatively—position themselves for huge upside when prices rebound.

5. Cash Flow Investors Become the Lifeline

Even underwater owners may let go of a home that no longer feels like an asset.

Investors who buy based on cash flow rather than appreciation step into opportunities most traditional buyers can’t touch.

The Bottom Line

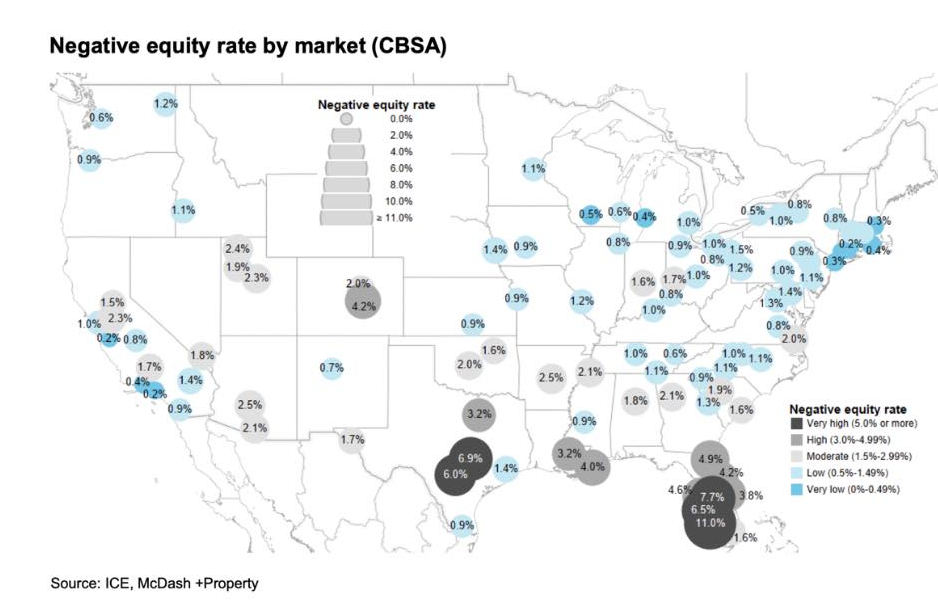

Negative equity is quietly spreading beneath the surface.

Most people don’t understand how dangerous it can be until a life event forces a sale they can’t afford.

But for real estate investors, this shift is creating one of the best buying climates since 2010— if you know how to structure deals, help homeowners ethically, and move before the market wakes up.

This isn’t doom and gloom.

It’s a signal.

Will you be ready to capitalize on it?