July 7, 2025 | 3 Minute Read

You might think I’m crazy for walking away from a triplex with an estimated 30% net ROI. That’s right—30% net. Some investors would have jumped all over this deal. But as always, the devil is in the details.

Curious why I passed? Read on.

Over the years, I’ve built strong relationships with local real estate agents. They often bring me their pocket listings, and when I buy, they act as dual agents—representing both the buyer and the seller in the transaction. That means they collect the full commission, instead of splitting it. Not all states allow dual agency, but here in Alabama, it’s perfectly legal. It’s a win-win: they double their commission, and I get access to purchase off-market deals.

Last week, I received an email from one of these agents. She offered me a triplex for $135,000 with $1,500 per unit in monthly rent—that’s $4,500/month or $54,000 annually in gross income.

Here’s the quick math:

Gross Income: $4,500 × 12 = $54,000

Estimated Expenses (25%): $13,500

Net Income: $40,500

Net ROI: $40,500 ÷ $135,000 = 30%

On the surface, it looked like a slam-dunk. I was excited —until I pulled the tax records.

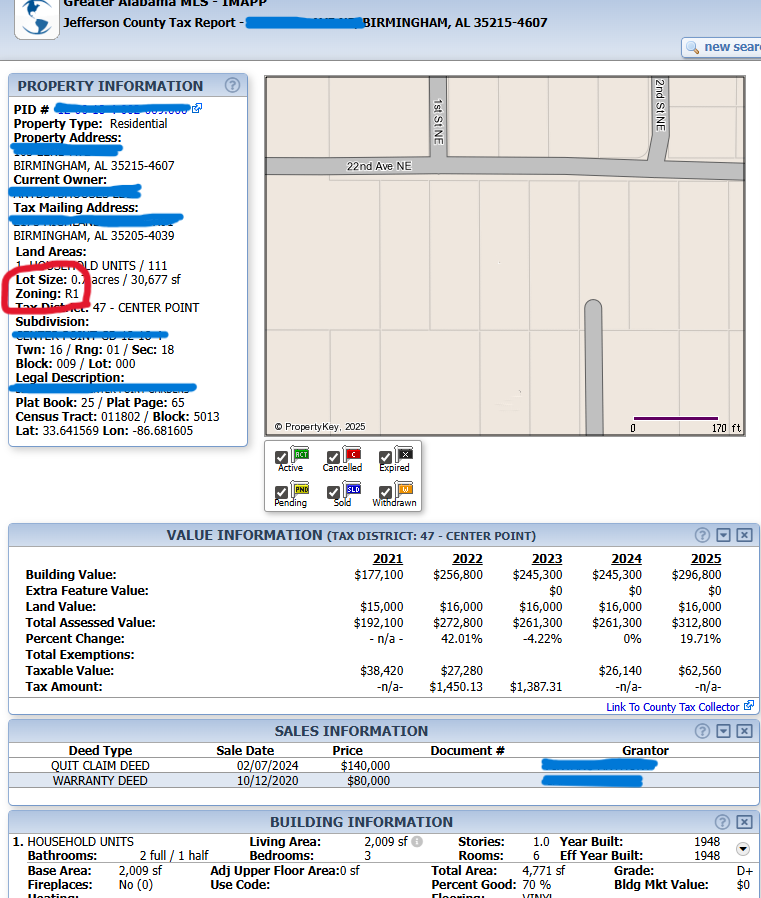

The property is zoned R-1, which is a Single-Family Residential District. You can also see from the building information, it is documented as a 3 bedroom/2 bath house.

It’s not legally a triplex.

Zoning for triplexes typically falls under multi-family designations such as R-3 or R-4, depending on the municipality. So I called the agent to ask more questions.

She told me each of the three units was 2 bed, 1 bath, about 800 sq. ft., and currently rented for $1,500 each—including utilities.

Wait—including utilities?

“Yes,” she said. “The base rent is $1,200, and tenants pay an extra $300 for utilities, bringing the total to $1,500 per unit.”

My next question was crucial but I already knew the answer and needed to confirm it: “Are the units separately metered?”

Her answer: “No, it’s one meter.”

Translation? This is essentially a single-family home that’s been illegally chopped into three separate units—with no proper rezoning or permits. Since it is one meter, the utilities are in the owner’s name.

She insisted it was a steal and said I could simply rezone it after the purchase. The agent said she checked with the city on rezoning and there were no issues.

Here’s why that’s not so simple:

The Truth About Rezoning

-

Applying for a zoning change (R-1 to R-3) would immediately trigger a city inspection. Once the inspector sees three separate living spaces with just one meter, the property would likely be hit with multiple fines for operating an illegal triplex. The agent might have checked with the city on rezoning requirements but had she given the address, then there would have been an inspection. So, her statement about checking with the city is misleading.

-

The rezoning process is no easy task. It requires:

-

Notifying all neighbors within a 500 feet radius of the property

-

Posting a sign on the lawn

-

Publishing a notice in the local paper

-

Attending a zoning board hearing where neighbors can voice objections

-

And since it’s already being used illegally, the city board is almost guaranteed to deny the rezoning request. Instead, they would require the property to be converted back to a single-family home, meaning:

-

Evicting all tenants

-

Renovating the structure

-

Paying all fines

And even if I did all of that, the after-repair value (ARV) is still only about $135,000—the same price the agent was asking. I’d be paying full market value for a legal single-family residence, not a triplex.

Then the agent added: “If you don’t take it, I have another buyer lined up. She wants to house hack—live in one unit and have the other two cover her expenses.”

I asked, “Is she paying cash?”

“No, she just needs to build her credit a bit and then she’ll get a loan,” the agent said.

Wait, what?

A loan? As in conventional financing?

That’s when I had to break it down for her:

Once the buyer applies for a multifamily commercial loan, the underwriter will review the tax records and see the property is zoned as single-family. Then, when the appraiser shows up and finds three units, one meter, and no legal multifamily zoning, they’ll make note of that in the appraisal.

As soon as underwriting sees the appraisal and zoning mismatch, the loan will be denied.

This deal looked incredible on paper, but it was full of legal and financial landmines. I’m not in the business of buying lawsuits—or paying retail for an illegal triplex I can’t finance, insure, or legally operate.

Deals with great numbers often come with hidden costs. In this case, the risk far outweighed the return.

So, I walked away—and I’m glad I did.