April 18, 2024 | Reading Time: 6 Minutes

Something profoundly unusual has unfolded in the American housing market over the past couple of years, marked by a rise in mortgage rates to around 7 percent.

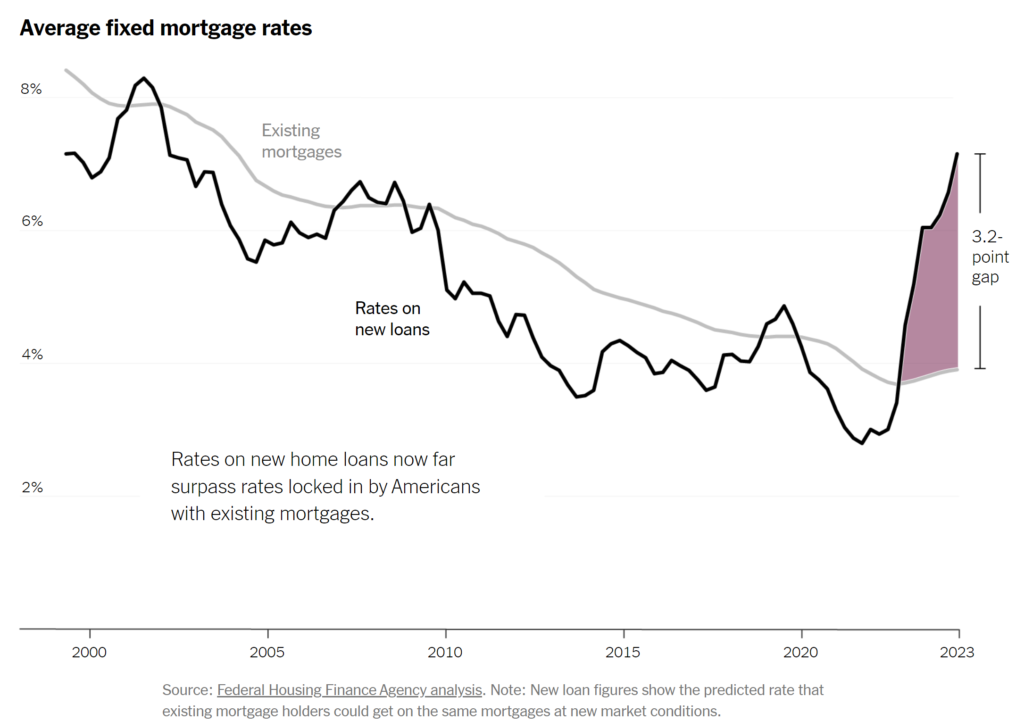

These rates, though not historically extraordinary by themselves, present a challenge due to the fact that the average American household with a mortgage holds a fixed rate that’s a substantial three points lower.

The picture tells it all. It shows the stagnation within the housing market, which could be contributing to a more widespread frustration with the economy.

This disparity has created a widespread phenomenon known as the lock-in effect, effectively trapping homeowners in their current residences even if they desire to move. While those not considering a move anytime soon benefit from the low rates secured during the pandemic, for many others, these rates have become a complication, disrupting household decisions and the housing market as a whole.

Research from economists at the Federal Housing Finance Agency reveals that this lock-in effect has led to approximately 1.3 million fewer home sales in America from the spring of 2022 through the end of 2023. This is a significant figure in a nation where around five million homes sell annually, with the majority being sold to existing homeowners.

These locked-in households have been unable to pursue better job opportunities, higher salaries, or adjust their living space. Consequently, this has driven up prices and created congestion in the market, hindering mobility for potential first-time buyers.

The dynamics of this situation are unprecedented. Unlike previous years where most mortgage holders could easily transition due to relatively similar rates, the recent spike in rates has made it financially unwise for many homeowners to consider selling their homes.

This shift has been particularly stark in the last two years as the Federal Reserve has grappled with inflation, resulting in a rapid increase in interest rates across various loan types.

While it might seem counterintuitive to identify a problem when many have secured favorable housing deals during the pandemic, the sudden rise in rates has created a scenario where selling a home might not make financial sense.

Think of your locked-in rate as an asset, suggests Julia Fonseca, a professor at the University of Illinois at Urbana-Champaign. Over this period, this asset has never been more valuable.

According to Fonseca’s estimates, locked-in rates are worth about $50,000 to the average mortgage holder, representing the additional amount one would have to spend if they switched to higher payments at today’s rates.

In other words, researchers at the F.H.F.A. calculated that this gap amounted to approximately $511 per month for the typical mortgage holder by the conclusion of 2023. This sum carries ample weight to sway household decisions and trigger significant ripples throughout the housing market.

This financial disparity is significant enough to influence household decisions and disrupt the housing market. Real families are unable to optimize their housing situations, notes Jonah Coste, an economist at the Federal Housing Finance Agency.

The repercussions of this situation are already apparent in other research. Mobility rates for homeowners with mortgages declined in 2022 and 2023, while there were no comparable declines for homeowners without mortgages or renters.

Furthermore, homeowners who are more locked in are less likely to move to areas with high wage growth, highlighting how housing market challenges can spill over into the labor market.

This predicament is not solely due to current high rates but also the sequence of events that led to this point. It’s an unprecedented situation, remarks Professor Rothstein.

While some of these effects may echo those seen after the 2008 housing crash, today’s challenge may be more enduring due to the long-term nature of 30-year mortgage rates and the unlikelihood of rates below 3 percent returning anytime soon.

President Biden has acknowledged the unease felt by many, promising that if inflation continues to decrease, mortgage rates will follow suit. In the meantime, he has proposed temporary tax credits for new buyers and sellers to mitigate some of the challenges.

For homeowners who have been hesitant to sell, however, these measures may not be sufficient to outweigh the considerable value represented by locked-in rates.

However, as numerous Americans remain in anticipation, he suggested temporary tax credits reaching a maximum of $10,000 for prospective new buyers and for the sellers who facilitate their purchases. For first-time buyers weighing the daunting mortgage calculations, the White House underscores that this credit translates to a reduction equivalent to over 1.5 percentage points for a span of two years, based on the median-priced home.

Conversely, for homeowners who have hesitated to sell thus far, this amount falls considerably short of the $50,000 value that fixed interest rates effectively offer to the average mortgage holder.