November 18, 2024 | 2.5 Minute Read

Last week, a memory popped up on my Facebook feed: a photo of my wife, Gina, setting up one of our short-term rentals. She and her mother Faye did an amazing job designing this property. I figured it was the perfect opportunity to discuss my reason why we converted it into a short term rental, and share exactly how much money we made.

Originally, this property was a long-term rental, rented at $1,193 per month, netting me $550 monthly. I’ve owned it for eight years and rented it twice during that time. The first tenant was so reckless that after she moved out, I was hit with a lawsuit by a third party who had been injured on the property months earlier—quite a shock (but that’s a story for another day). The second tenant didn’t take care of the property either, and I would have to invest quite a bit to get it rent-ready again. All the income I’d earned over the last several years was just going back into repairs. What’s the point of having a cash-flowing property if it doesn’t actually cash flow? I was ready for a change.

By then, my company had already converted six other long-term rentals into short-term rentals, and they were meeting expectations. I wondered: could this property do just as well?

I needed to ask myself two questions:

Will it succeed as a short-term rental, producing at least three times the net income it generated as a long-term rental?

With a total conversion cost of $82,586.62, how long will it take to recoup this investment?

The property, which we call “The Vista,” is a 4-bedroom, 2-bath house with 1,800 square feet. It has two living rooms, a dining area, a large kitchen, and both front and back covered patios with a large fenced backyard. It sleeps nine.

On Airbnb, it has a 4.92-star rating (out of 5) with 52 stellar reviews: Airbnb Listing

On VRBO, it has a 9.8-star rating (out of 10) with 20 excellent reviews: VRBO Listing

Since launching it as a short-term rental in early December 2022, it has exceeded expectations.

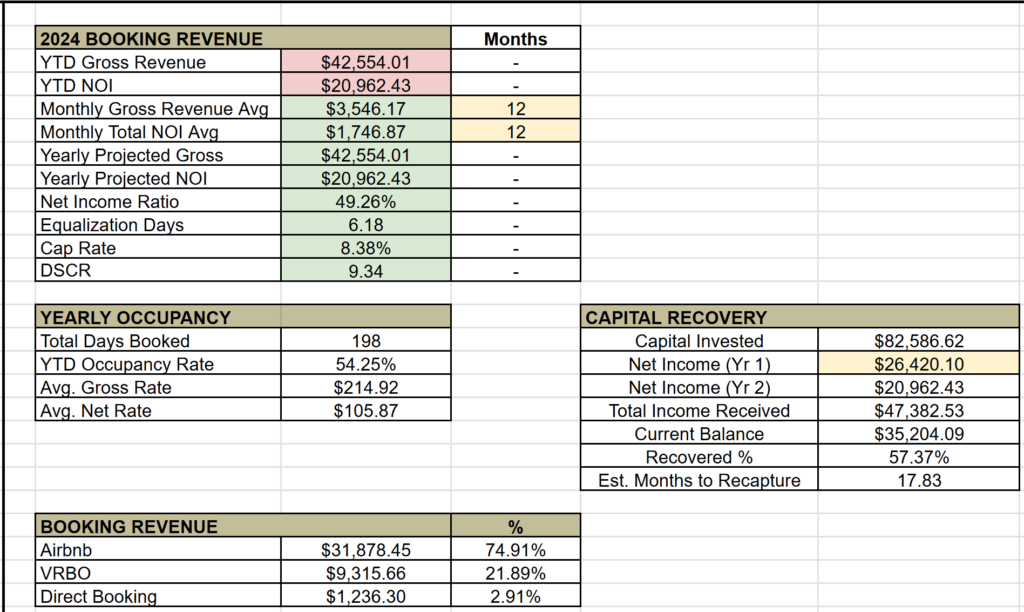

Let me show you exactly how much we made in the last two years (Calendar year ends 30 November):

2023 Earnings:

Gross Income: $45,613.76

Net Income: $26,420.10

Monthly Net: $2,201.68 monthly (4X compared vs. long-term rental)

Occupancy: 232 days booked, 69.25% occupancy, with an average daily rate (ADR) of $196

Net Income Ratio: 57.92% (meaning we kept 58 cents for every dollar earned)

Equalization Days: 4.67 (the number of days at ADR needed to cover monthly expenses; anything below 10 is ideal)

Cap Rate: 10.57%

Debt Service Coverage Ratio (DSCR): 7.76 (banks require a 1.5 DSCR minimum when refinancing an STR)

Booking Ratios: 50.71% VRBO / 41.82% Airbnb

2024 earnings:

Use the code STRF for a 50% discount

Why less my second year? I had to take the property offline twice for a month due to a collapsed sewer line, and trim a tree and its branches away from the roof; a combined repair cost of about $5,000.

Total 2023/2024 YTD Income:

Gross: $91,167.77

Net: $47,382.53

Monthly Net: $1,974.27 avg. (4X vs. long term rental)

And the $82,586.62 I invested? The outstanding balance is currently $35,204.09 and it will take approximately 18 more months to fully recoup provided the financial projections match or exceed the previous two years earnings.

Was it worth it converting this property to a short term rental? YOU BETCHA!!