January 5, 2026 | 3 Minute Read

As many of you know, we’ve been operating short-term rentals (Airbnb) since April 2022. At our peak, we scaled to 18 properties. Today, we operate eight, with a ninth set to launch hopefully later this week. The reasons we cut our portfolio in half deserve their own article, so I’ll save that for another time.

Of the eight active properties, five are owned by the company, two are my personal properties, and one belongs to my business partner. After several years of operations, we now have enough historical data to optimize performance and ensure these properties remain profitable.

In this article, I want to focus specifically on my two personal short-term rentals and how they performed in 2025.

Understanding the Type of Rentals We Operate

Before diving into the numbers, it’s important to understand what these properties are—and what they are not.

These are not luxury vacation rentals. They are necessity rentals. Guests stay for very specific reasons: work assignments, family events, weddings, funerals, or downtown events. Both properties are located in C+ to B-class neighborhoods, which means my pricing strategy is not about maximizing nightly rates. Instead, the primary focus is occupancy and remaining competitive with nearby hotels.

With that context, let’s look at the performance of each property.

The Vista

The Vista is an 1,800 sq. ft., 4-bedroom, 2-bath home that launched as a short-term rental in December 2022. Before converting it, the property was rented as a Section 8 rental for $1,197 per month, netting approximately $330 per month after expenses.

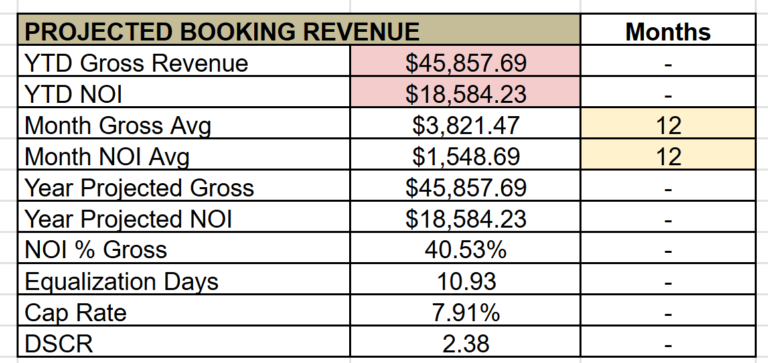

Booking Revenue

In 2025, The Vista grossed nearly $46,000 and netted approximately $18,500, or about $1,550 per month. That represents a 40% profit margin. The property required only 11 booked days per month to cover all expenses—what I refer to as “equalization days.”

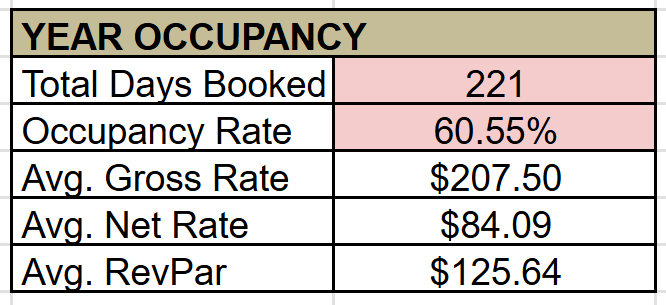

Occupancy

The property was booked 221 days, resulting in 60.5% occupancy, well above the local average of 51%. The average nightly gross rate was $207.50, with a net of $84 per night.

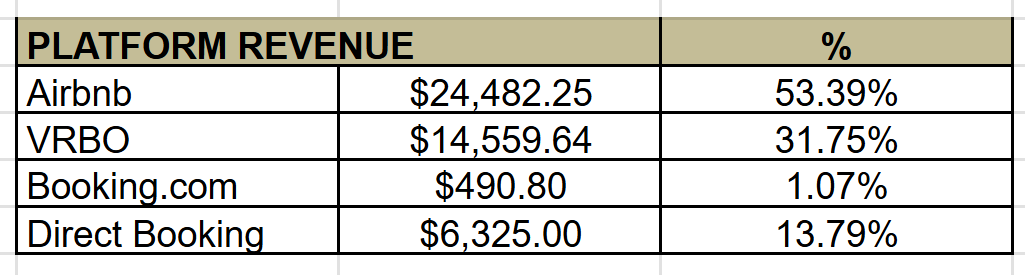

Platform Revenue

You can see below that more than half of the bookings (53%) came through Airbnb followed by VRBO at almost 32%. I just started listing the property on Booking.com in December and only received my first booking.

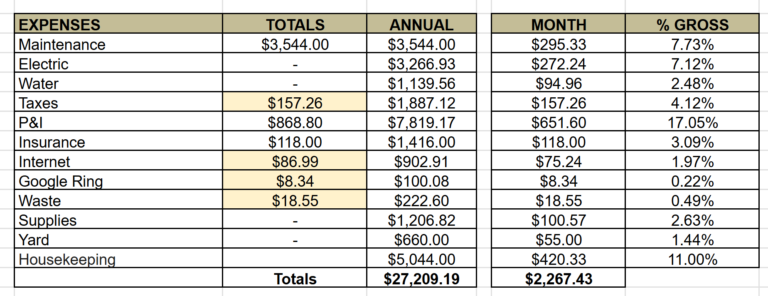

Expenses

The largest expense was principal and interest (following a refinance in April 2025), followed by housekeeping and maintenance.

The Hilltop

The Hilltop is a 1,425 sq. ft., 3-bedroom, 2-bath home that launched in May 2023. Previously, it was rented as a Section 8 property for $1,110 per month, netting around $250 per month.

I’ll be honest—this property was challenging.

The first year, I barely broke even. The second year, I made a small profit. I seriously considered converting it back to a long-term rental but decided to give it one more year. My thinking was simple: if I could consistently net at least $300 per month, it would be worth keeping as a short-term rental.

Thankfully, 2025 delivered.

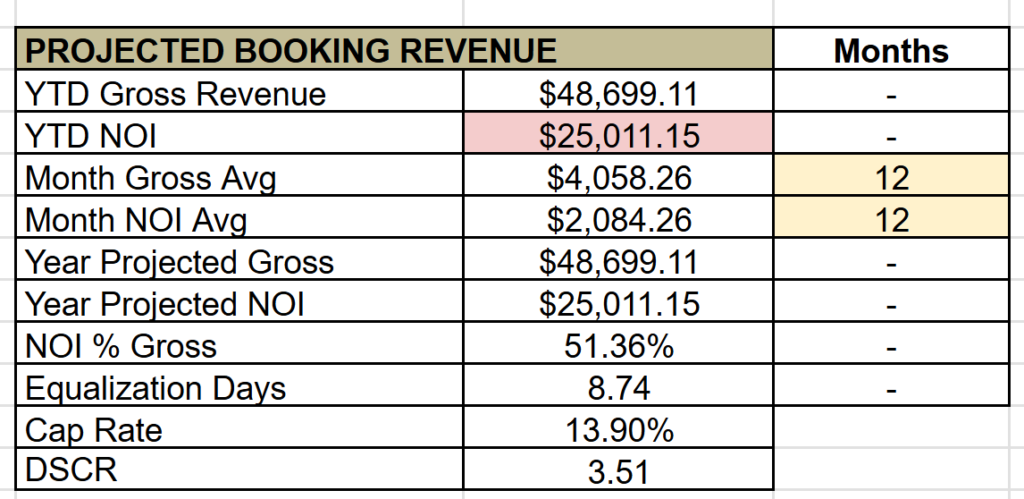

Booking Revenue

The Hilltop grossed nearly $49,000 and netted approximately $25,000, or about $2,085 per month. That’s a 51% net profit margin, with equalization days under nine days per month.

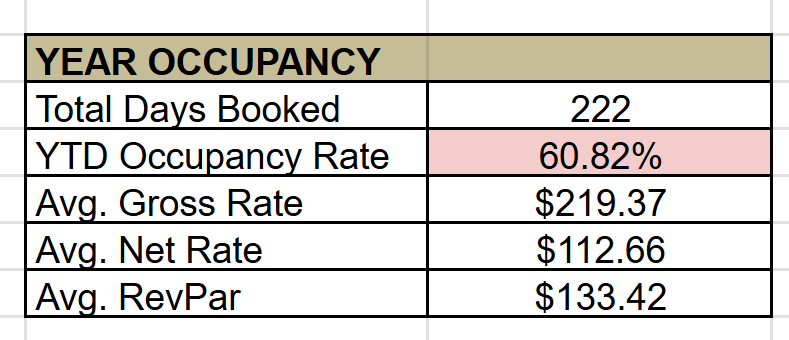

Occupancy

The Hilltop had 222 booked days, also achieving 60.8% occupancy. The average nightly gross rate was $219, and the net was $112 per night, higher than The Vista due to reduced turnover.

Why Did The Hilltop Outperform The Vista?

The key driver was a mid-term guest from January through March. The stay was paid by an insurance company at $6,400 per month, which significantly boosted profitability, increased occupancy, and eliminated monthly housekeeping costs during that period.

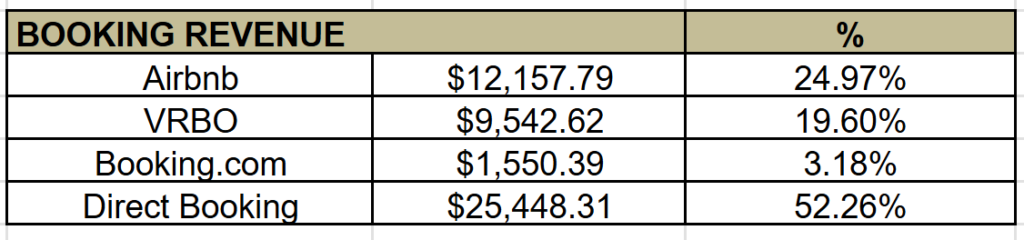

Platform Revenue

As a result of the mid-term booking, 52% of the income came through as a direct booking. Airbnb was about 25% and VRBO almost 20%. Again, Booking.com is a new platform and in December received two bookings.

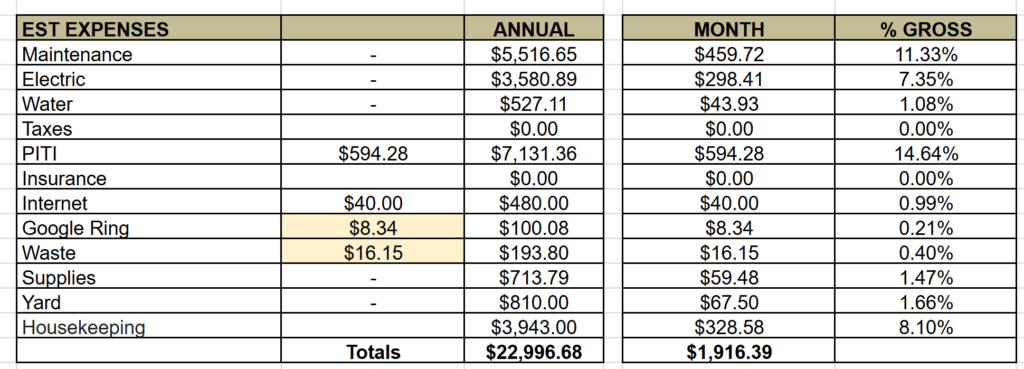

Expenses

Mortgage payments accounted for about 15% of expenses, followed by 11% maintenance and 8% housekeeping. Maintenance was unusually high due to several major issues: septic and plumbing repairs in November, a fallen tree requiring removal in December, and repairs to both the washing machine and dishwasher.

This property has been an uphill battle, and at times it has felt cursed. That said, I’m confident the worst is behind us.

Final Numbers and Takeaways

In 2025, the two properties combined generated:

$94,556.80 in gross income

$43,595.39 in net income

$3,632.94 in monthly net cash flow

For comparison, these same two properties previously netted $580 total per month as Section 8 rentals. That’s a six-fold increase in net income.

One final note: a mid-term guest moved into The Vista in December at $5,750 per month through the end of March 2026. Based on prior experience—where mid-term stays average around six months—I expect this booking to extend through at least May.

Every year brings new challenges so this year, my goal is to grow direct bookings while increasing reservations through VRBO and Booking.com. By diversifying revenue streams, I aim to reduce reliance on Airbnb while continuing to maintain occupancy at or above 60%.

With necessity-driven short-term rentals, you won’t reach the high returns that luxury rentals offer. Following my approach, your goal should be at least a 5X income increase over long-term rental projections—enough to justify the management effort and benefit from lower maintenance costs compared to a Section 8 tenant.

Next week, we’ll take a deeper look at how the company’s five short-term rentals performed in 2025.