January 12, 2026 | 3.5 Minute Read

Last week, I broke down the performance of my two personally owned short-term rentals and how they generated $95,000 in gross income in 2025. In this article, I want to shift the focus to how our company-owned portfolio of five short-term rentals (STRs) performed over the same period.

Related case study:

Two Section 8 Rentals → Airbnb’s = $95,000

Property Locations & Strategy

All five STRs are located in Birmingham, specifically in the Roebuck, East Lake, and Center Point areas. These are what most investors would classify as C-class neighborhoods.

Because of this, we are not competing with downtown luxury STRs that command premium nightly rates based on walkability and proximity to entertainment districts. Our properties are located roughly 10 miles north of downtown, so our strategy is different:

Lower nightly rates

Higher occupancy

Consistent demand from families, work crews, and mid-term guests

This approach has proven to be far more reliable for our locations than attempting to chase luxury pricing.

What Worked (and What Didn’t)

Our current portfolio consists of:

Two 4-bedroom / 2-bath homes

Three 3-bedroom / 2-bath homes

One key lesson we learned early on is that 3-bedroom / 1-bath properties simply did not perform well as short-term rentals in these areas. We previously operated several of them, but the results were underwhelming.

As a result, we:

Converted some back to long-term rentals

Sold others to turnkey investors

Standardized our STR criteria to 3/2 or larger only

This change alone had a major impact on performance.

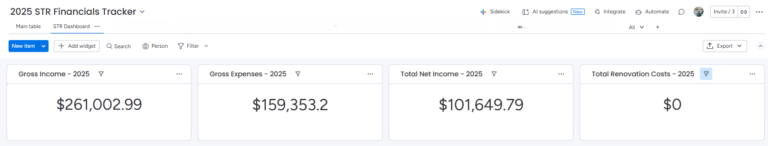

2025 Financial Breakdown

Here’s how the five properties performed collectively in 2025:

That breaks down to:

- $21,750.25 per month in gross income

- $8,470.81 per month in net income

$1,694.16 per door per month net

Section 8 vs. Short-Term Rentals

Every one of these properties was previously a Section 8 rental.

As long-term rentals, the numbers looked like this:

Annual gross rent: ~$63,600

Monthly gross: ~$5,300

Net profit: ~$200 per door

Total net: ~$1,000 per month or $12,000 per year

After converting them to short-term rentals:

Annual net income exceeded $100,000

That’s the difference between surviving and scaling.

Conversion Costs

It’s important to be transparent here.

We spent approximately $30,000 per door to convert these homes from long-term Section 8 rentals into short-term rentals. For all of the properties, the first year of operation was largely about recapturing that conversion cost.

Once that hurdle was cleared, the properties began producing strong, predictable cash flow.

Individual Property Performance

The Redmont (Birmingham)

Gross Income: $59,438.71

4 bed / 2 bath

Our top-performing property year after year

Located in a solid area with excellent highway access

Strong demand from corporate work crews and mid-term guests

Currently hosting a work crew from November through February

The Argonne (Center Point)

Gross Income: $58,302.06

3 bed / 2 bath

Located in a desirable area

Consistently attracts mid-term guests

Hosted mid-term stays for 8 months last year

Current mid-term guest booked from October through March

The Bungalow (Center Point)

Gross Income: $49,981.50

4 bed / 2 bath

Located in a weaker area, so affordability is key

Performs well with corporate and contractor housing

The Roebuck (Birmingham)

Gross Income: $48,701.37

3 bed / 2 bath

Convenient to the highway, hospital, and Trussville

Attracts a high number of families

Consistently solid performer

The Chalet (Birmingham)

Gross Income: $44,579.33

3 bed / 2 bath

Our first-ever short-term rental

Has performed reliably for over four years

Popular with families and guests attending downtown events

Only about 10 minutes from downtown Birmingham

Key Lessons Learned

1. Mid-Term Rentals Were the Game Changer

Mid-term guests accounted for approximately 25% of our total revenue in 2025. These stays dramatically reduce turnover, cleaning costs, and vacancy.

We actively market to:

Insurance placement companies

Relocation services

Corporate housing providers

Because of our track record, we are now on the short list for several of these organizations, positioning us well for 2026.

2. Property Size Matters

Going forward, 3 bed / 2 bath is the minimum for any new STR in our markets. Smaller properties simply don’t justify the effort or management involved.

Looking Ahead to 2026

We are launching a brand-new STR (The Magnolia) this week directly across the street from The Roebuck. The properties are nearly identical.

If The Magnolia performs in line with its twin and we maintain 25% mid-term occupancy, our projected net income target for 2026 should be in the six figures.

This strategy continues to prove that necessity-based short-term rentals, when executed correctly, can outperform traditional long-term rentals by a wide margin—even in non-luxury markets.