November 10, 2025 | 2.5 Minute Read

I get a lot of emails from wholesalers pitching their latest “deals.” Some are local, but many come from out-of-state virtual investors. That’s an important distinction.

A local wholesaler typically knows the neighborhood on a street-by-street level. They understand which side of the block gets better rents, what recent MLS comps support their ARV, and they usually have quality photos and boots-on-the-ground insight.

A virtual wholesaler, on the other hand, often relies on third-party tools like PropStream or Zillow to estimate value. Their numbers tend to look cleaner on paper—but they usually lack the local knowledge that determines whether a deal truly works.

And that difference matters.

When a local wholesaler presents a property, there’s usually less room to negotiate. They’ve done their homework and understand the market. With a virtual wholesaler, however, there’s often more room to negotiate because their data is surface-level at best.

That is, if the deal makes sense.

This past week, a virtual wholesaler from Atlanta reached out to me with a property on Dublin Avenue here in Birmingham. It’s in a lower-income, C-class neighborhood I know well. I’ve bought and turnkey-flipped houses there years ago, but I stay out of that area now—it’s just too tough to flip and difficult to hit our target rents as a buy and hold.

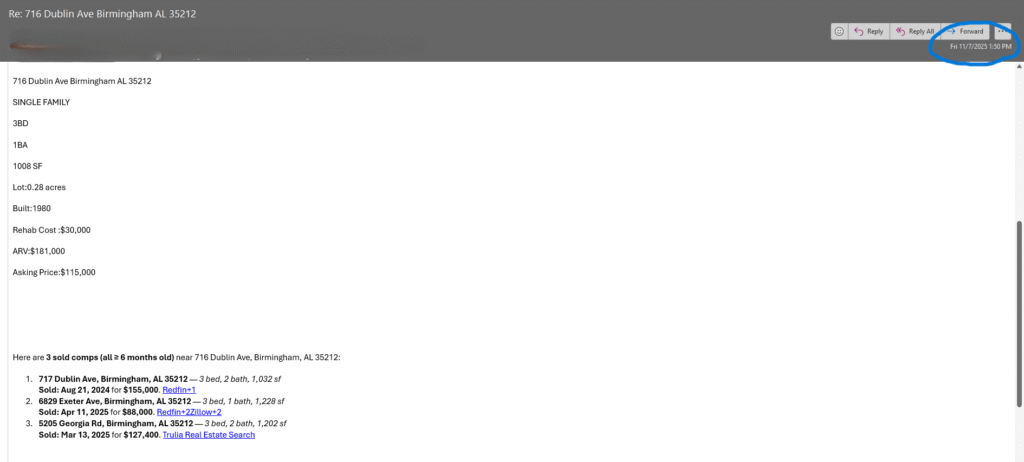

At 1:50 PM, I received his email.

He claimed an ARV of $180,000, a $30,000 renovation budget, and an asking price of $115,000. That puts the total investment at $145,000, or roughly 80% LTV—leaving only a $35,000 spread. But any experienced investor knows we won’t pay more than 75% LTV for a deal like this. Once you add in holding costs, closing fees, agent commissions, and any budget overruns, you’d be lucky to break even even if the property actually sold for $180,000.

Then I looked at his comps—and they raised even more red flags. His “best” comp was 15 months old, and a more recent sale at $88,000 was larger than the subject property. He also couldn’t explain how he calculated the $30,000 renovation budget.

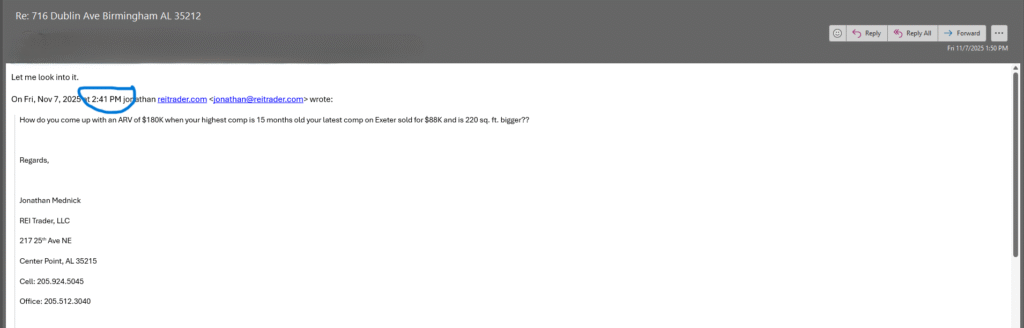

Here’s the email he sent back at 1:50pm after I questioned his numbers saying he will “look in to it.”

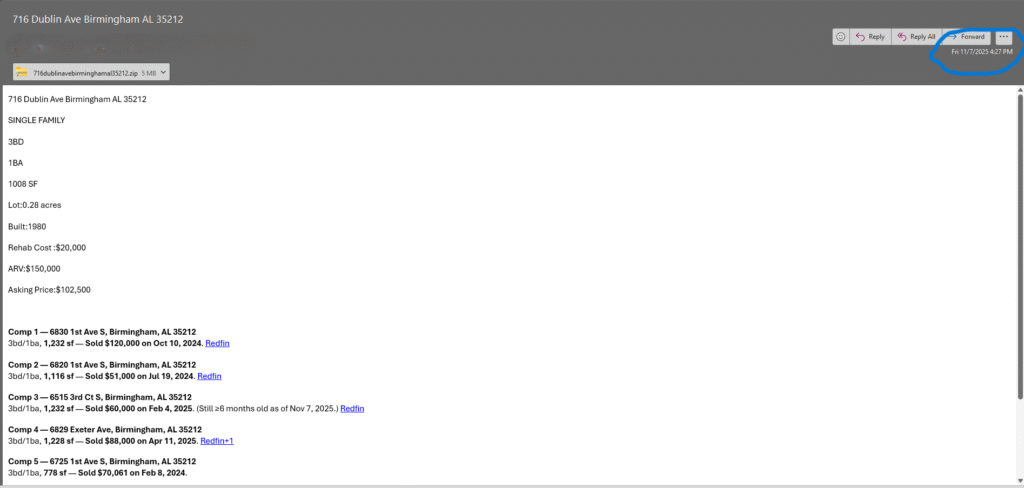

A few hours later, at 4:27 PM, another email arrived from him.

He had now reduced the price to $102,500, dropped the ARV to $150,000, and lowered the rehab estimate to $20,000. That increased the LTV to 82%, which made even less sense. To top it off, all his comps had changed—now ranging from $50,000 to $70,000—yet his asking price remained more than double that range.

When someone can drop the ARV by $30,000, the asking price by $12,000 and reduce the renovation budget by $10,000 in a few hours, that tells you all you need to know. He wasn’t analyzing numbers—he was manipulating them to preserve an imaginary 20% margin.

Real deals are built on local knowledge, thorough analysis, and realistic numbers, not wishful thinking. When you are wholesaling, credibility comes from knowing your market, not guessing from a distance. The next time a deal like this lands in your inbox, remember: if the math keeps changing, it’s probably not a deal worth chasing.

I won’t tell you my final response to him but let’s just say, I will not be receiving any more “deals” from this wholesaler.