September 22, 2025 | 4 Minute Read

Last week, the Federal Reserve lowered rates by 0.25%. For real estate investors, especially those considering refinancing, this shift opens new opportunities. But not every investor’s situation is the same.

Broadly, three types of investors need to consider how this affects them:

Short-Term Rental Investors with 5/1 ARMs – Many investors who locked in low rates (around 4.5%) in early 2020 are now facing loan expirations. If their banks won’t extend, refinancing is inevitable. The good news is that they have a low cost basis with a considerable amount of equity.

Investors Waiting on the Sidelines – Those who delayed refinancing or purchasing until rates dropped are now ready to jump in.

Investors Stuck in High-Cost Bridge Loans – Borrowers who used expensive short-term capital and need to refinance into long-term debt, using the BRRRR strategy.

We’ve already discussed the first scenario in a prior post: Cash Flow vs. Equity.

Here, we’ll focus on the second and third scenarios.

Sitting on the Sidelines

If you’ve been waiting for rates to fall before jumping in, the reality is you’ve likely missed out on some major gains.

Homeowner Equity Growth: As of Q2 2025, U.S. homeowners held about $35.8 trillion in equity, up from $32.0 trillion in Q2 2023. That’s an increase of $3.8 trillion in just two years.

In 2023 alone, the average homeowner gained $25,000 in equity, though that slowed to about $4,500 in 2024.

Date the Rate

Those who continued buying—even during peak rates—are ahead of the game. Despite higher borrowing costs and favorable purchase pricing, the equity gains more than offset the added expenses of closing fees, prepayment penalties, and higher interest rates. Now, those investors are positioned to refinance down from rates around 8.5%+ to 6.75% or lower. If this was your strategy all along during this high interest period, you are ready to recapitalize.

BRRRR Strategy Refinance

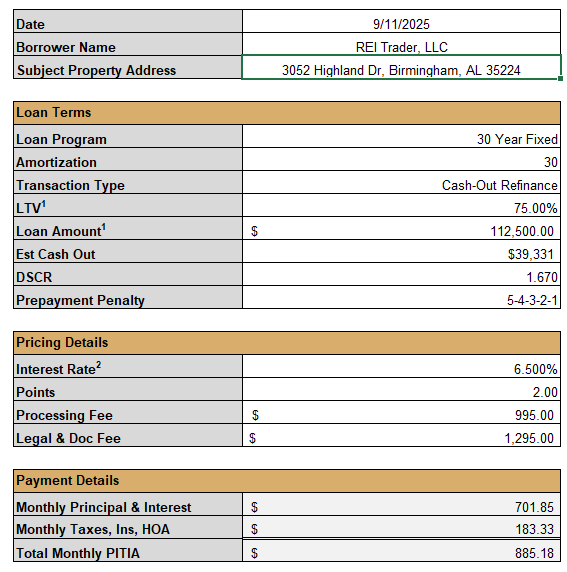

Here’s one of my refinances currently in underwriting for one of our properties using the BRRRR method:

ARV: $150,000

30 Yr Fixed Loan (75% LTV): $112,500

PITI @ 6.5%: $885.18

Section 8 Rent: $1,484

Est. Net Income: $598.82

That’s excellent cash flow. I could buy the rate down to 6.25% for $1,125, but the $18.40 monthly savings would take five years to recover. Since that’s the same timeline as the prepayment penalty window, it’s not worth it for me. The right choice depends on your goals.

And, my current note payoff is $95,000 so after closing costs, I will recoup 100% of my investment and pocket about $6,000 after closing costs. Cha… ching!

Single-Family Refinance

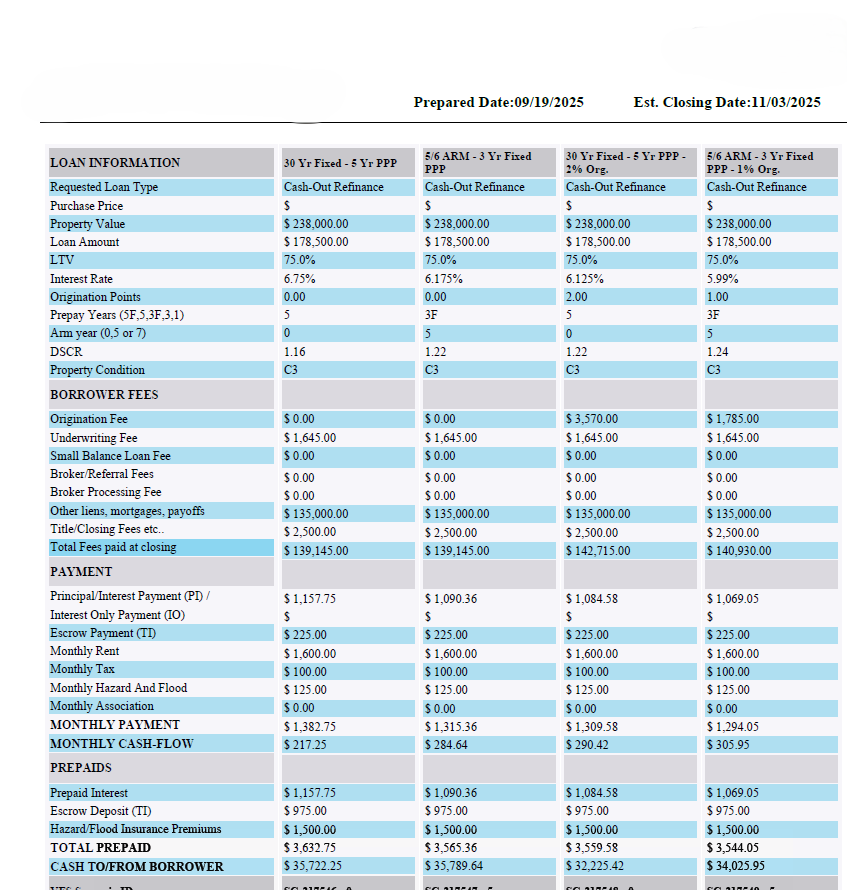

I’m currently brokering a loan for an investor refinancing a single-family rental. Here’s the term sheet numbers from another lender:

ARV: $238,000

30 Yr Fixed Loan (75% LTV): $178,500

PITI @ 6.125%: $1,294.05

Est. Monthly Rent: $1,600

- Est. Net Income: $305.95

While teaser rates can appear too good to be true, they are real—just structured with conditions. Understanding those strings allows smart investors like you to benefit.

How to Get the Best Rates

Experience Level – Lenders score investors based on track record over the last three years, from Tier 1 (new, 3–5 projects) up to Tier 5 (23+ projects). More experience = better terms. This could be a combination of flips, recent purchases, rentals, or refi’s.

Credit Score – A FICO of 740+ can shave off an additional 0.25 and access the max LTV available. Less than 700 and you will see a 5% haircut on your LTV.

Loan-to-Value (LTV) – The max LTV on a refinance is 75% or 80% on a purchase. If your cost basis is low and you do not need to tap into all your equity, reducing the LTV by 5% could shave .35 to .5 off the rate.

After-Repair Value (ARV) – Higher-value properties generally qualify for better rates. If you are sub $150,000 ARV, expect a higher rate. In my examples, the rate difference between $150,000 and $238,000 properties was 0.625.

Location – Markets with declining property values may see lenders reduce max LTV by 5% which may still get you to a lower rate.

Buydowns – Paying points upfront can lower your rate, but every lender has a floor. Know it before buying down.

- Origination Points – Some lenders may offer a reduced rate by raising their origination fees in lieu of a point buydown. Is there really a difference? Not much. For commercial lenders, this is a common and acceptable practice—it’s simply another method of offering you a lower rate.

The Fed’s recent rate cut is a small step, but it signals opportunities for investors. Those who kept buying during high-rate years are now well positioned to refinance into stronger cash flow. And, investors stuck with expensive bridge loans or sitting on the sidelines need to act. The key is understanding how experience, credit, LTV, ARV, and location affect your financing terms.

In short: the market is rewarding action-takers. Whether through the BRRRR strategy, refinances, lowering borrowing costs, or lowering your cost to borrow, the investors moving today are setting themselves up for significant long-term future gains.

Thinking about refinancing your rental properties? Reach to me at guru@rei.school if I can be of assistance.