July 14, 2025 | 3 Minute Read

A growing number of homeowners are pulling their listings off the market after failing to attract buyers willing to pay their asking price—a sign that many sellers would rather sit tight than negotiate in a softening housing environment.

According to Realtor.com’s latest housing trends report, national delistings surged 47% in May compared to the same time last year. Year-to-date, delistings are up 35%. This behavior marks a notable shift in seller psychology—and creates new dynamics that investors must watch closely.

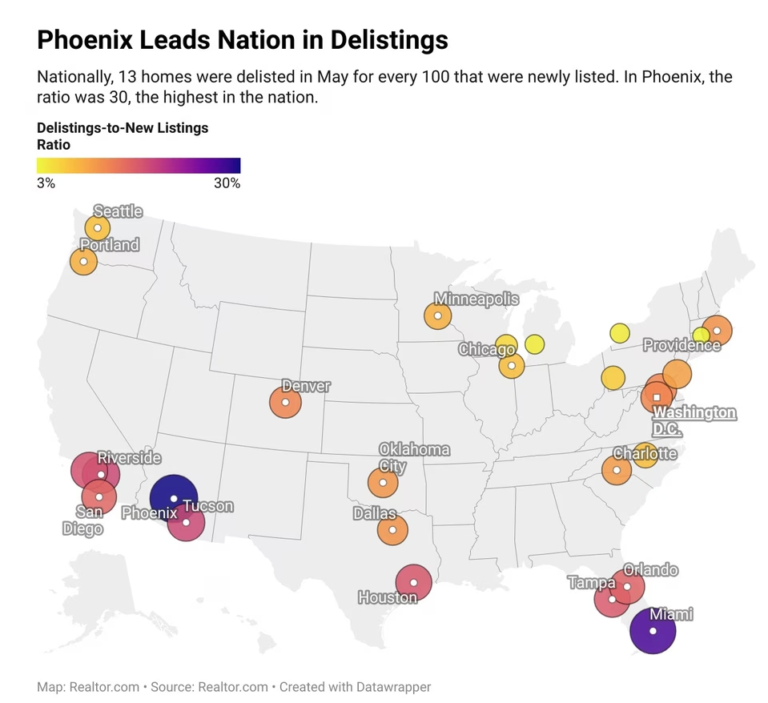

The move comes amid a rise in active listings, which grew 29% in June year-over-year. New listings only rose 6.2% and have remained flat for two months, but delistings are outpacing new listings, with 13 homes delisted for every 100 new ones listed in May. That’s up from 10 last year and more than double the rate seen in 2022.

This trend follows a wave of price reductions and reflects the growing divide between seller expectations and market reality. Many sellers, buoyed by strong home equity positions, are choosing to withdraw their properties rather than accept lower offers.

“Unlike past cycles where price drops forced distressed sales, today’s homeowners have equity cushions that give them the luxury of waiting,” explains Realtor.com senior economist Jake Krimmel.

But this seller reluctance introduces a form of gridlock that may limit inventory movement and delay price corrections—two key risks for investors banking on predictable market dynamics.

Risk #1: Stagnant Inventory and Unrealistic Seller Expectations

Sellers anchored to peak-pandemic pricing are stalling transactions, especially in oversupplied regions like the South and West. Phoenix tops the delisting chart, with 30 homes delisted for every 100 newly listed in May. Denver, Austin, and other Sunbelt cities—once investor favorites—are seeing a similar cooling effect.

This stagnation can force investors to hold cash longer, overpay, or accept thinner margins, especially in markets where sellers won’t budge but competition for quality deals remains high.

Risk #2: Price Cuts Without True Discounts

While more homes are experiencing price reductions (20.6% of listings in June, the highest June share since at least 2016), median list prices remain stubbornly high at $440,950—up 0.2% year over year. This disconnect reveals that price cuts aren’t necessarily creating investor opportunities, but rather softening high expectations.

In Denver, 34% of listings saw price reductions in June, followed closely by Phoenix and Austin. Yet home values in these cities remain out of sync with investor underwriting models, particularly those relying on the 1% rule or targeting fast appreciation.

Risk #3: Shifting Toward a Buyer’s Market—But Not Yet

With inventory levels rising—active listings topped 1 million in June for the second month in a row—and days on market stretching to 53 (matching pre-COVID norms), the market is tilting slightly in favor of buyers. But that transition remains uneven.

“We’re in a tug-of-war between buyer leverage and seller expectations,” says Realtor.com chief economist Danielle Hale. “Whether we move into a true buyer’s market—and how fast—will depend on how sellers respond in the second half of the year.”

For investors, this means timing and local knowledge are critical. Buying too soon in markets that have not yet bottomed—or waiting too long and missing peak leverage—can drop profits or lead to overexposure.

Risk #4: Regional Imbalances Could Skew Returns

While some metros saw median list prices rise—Baltimore (+7%), Virginia Beach (+5.2%), and Buffalo (+3.8%)—others saw declines: Cincinnati (-6.3%), Sacramento (-4.8%), and Miami (-4.7%).

These disparities highlight the need for hyper-local analysis. Investors who assume uniform national trends may misread opportunities—or walk into riskier deals than anticipated.

The Bottom Line for Investors

The increase in delistings and persistent seller optimism signals a real estate market in transition—but not yet fully corrected. For investors, this creates a dangerous illusion of opportunity. More listings and longer days on market might look like a buyer’s market on paper, but if sellers continue to wait for top dollar, inventory becomes stale rather than strategic.

Key Takeaways:

Expect longer deal cycles: Investors may need to engage in prolonged negotiations or creative deal structures.

Don’t rely on list price drops alone: Many “discounts” are superficial and don’t reflect real value.

Focus on motivated sellers: Tired landlords, distressed owners, or those with time constraints may present the best opportunities in the current market.

Monitor regional shifts closely: Some markets are correcting faster than others.

With the gap widening between buyer power and seller expectations, smart investors must navigate this new terrain carefully. The next 6–12 months could reward patience, discipline, and deep local insight.