January 20, 2025 | 2.5 Minute Read

In the early 1980s, nearly 40% of newly built homes were considered entry-level. By 2023, only 9% of new homes fit this category. If this trend continues, the affordability of homeownership for younger generations will become increasingly out of reach.

Simultaneously, the homebuilding industry is slowing, exacerbating the decline of starter homes. Both housing starts and building permits—indicators of future construction—have decreased, and this downturn is not merely seasonal.

Millions of potential first-time buyers are contending with high home prices that continue to climb.

Some markets, particularly those two to three hours away from major metropolitan areas, are experiencing price bubbles. The current housing landscape is unusual, with an all-time low in first-time buyers and an all-time high in all-cash buyers.

Where Have All the Starter Homes Gone?

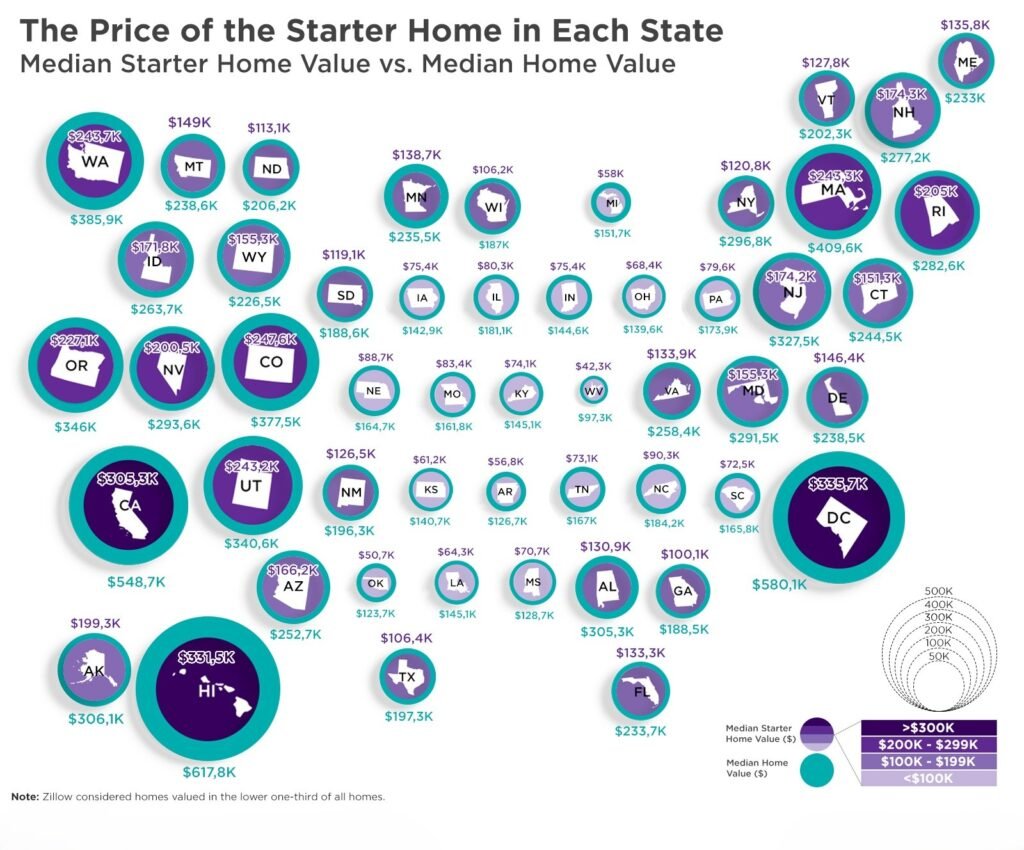

A starter home is traditionally modest in size and price, making it the most affordable option in any given market. In the Midwest and South, this might mean a home price

.

In the past, a starter home might have been a small condo or space that buyers upgraded from as their circumstances evolved. However, more first-time buyers are now purchasing single-family homes with long-term plans to stay put.

Despite demand, homebuilders are constructing fewer starter homes. Over the past decade, fewer than 100,000 single-family homes under 1,400 square feet have been built annually—down from 400,000 to 500,000 per year in previous decades. This decline is largely due to challenges with zoning regulations.

Local zoning laws dictate lot sizes, setbacks, building heights, and the number of units allowed per site. In many cases, these restrictions provide avenues for residents to oppose new developments, citing concerns such as school overcrowding and increased traffic. Density restrictions often favor single-family homes over townhouses or condos, limiting opportunities for affordable housing.

Housing Markets and Construction

Trends To adapt, homebuilders and first-time buyers are targeting suburban and exurban areas. These regions have seen the fastest increases in home values, as buyers move farther from urban centers. Some cities with less restrictive zoning, like San Antonio, are seeing the construction of smaller single-family homes under 1,000 square feet, a rarity just a few years ago.

Metro Atlanta is another example of a region accommodating new residents with a mix of affordability and culture. Less restrictive zoning codes in areas like Atlanta have attracted newcomers seeking vibrant communities and accessible lifestyles.

Experts suggest that relaxing zoning restrictions and exploring innovative solutions like accessory dwelling units (ADUs) or adaptive reuse of vacant properties could increase housing supply and affordability.

Financial Barriers to Homeownership

Financial hurdles remain a significant challenge for first-time buyers. Over the past decade, the cost of buying a home has risen sharply relative to renting. Home prices have outpaced wage growth, pushing the median age of first-time homebuyers from 29 in 1981 to 38 today.

Rising student loan debt, car loans, credit card debt, and increasing rents make saving for a down payment difficult. The most affordable homes are in highest demand, yet the supply is critically low. National home prices have surged by over 52% from 2020 to 2024, and mortgage rates have returned to historical norms near 7%, further straining affordability.

Many first-time buyers now rely on inheritance, savings from retirement accounts, or stock sales to make all-cash purchases. Investors are also active in the market, especially in fast-growing, affordable areas in the South. While large-scale investors only account for 1-2% of the overall housing market, their presence in specific regions can create challenges for individual buyers.

With supply shortages and elevated prices, the first-time homebuyer market faces significant barriers. Addressing these challenges will require policy changes, creative solutions to increase inventory, and financial assistance for buyers. Until then, the dream of homeownership may remain out of reach for many.