One effective way to find off-market properties is by building relationships with real estate agents who have pocket listings of distressed properties they aim to sell for cash. Many seasoned agents have investors on speed dial, benefiting from quick cash offers and, when permitted, acting as dual agents to retain the full commission without splitting it with another agent.

Additionally, some agents reach out with MLS listings they are struggling to sell. Often, this involves newer agents hungry for listings, but sometimes they take on listings they shouldn’t. Let me explain.

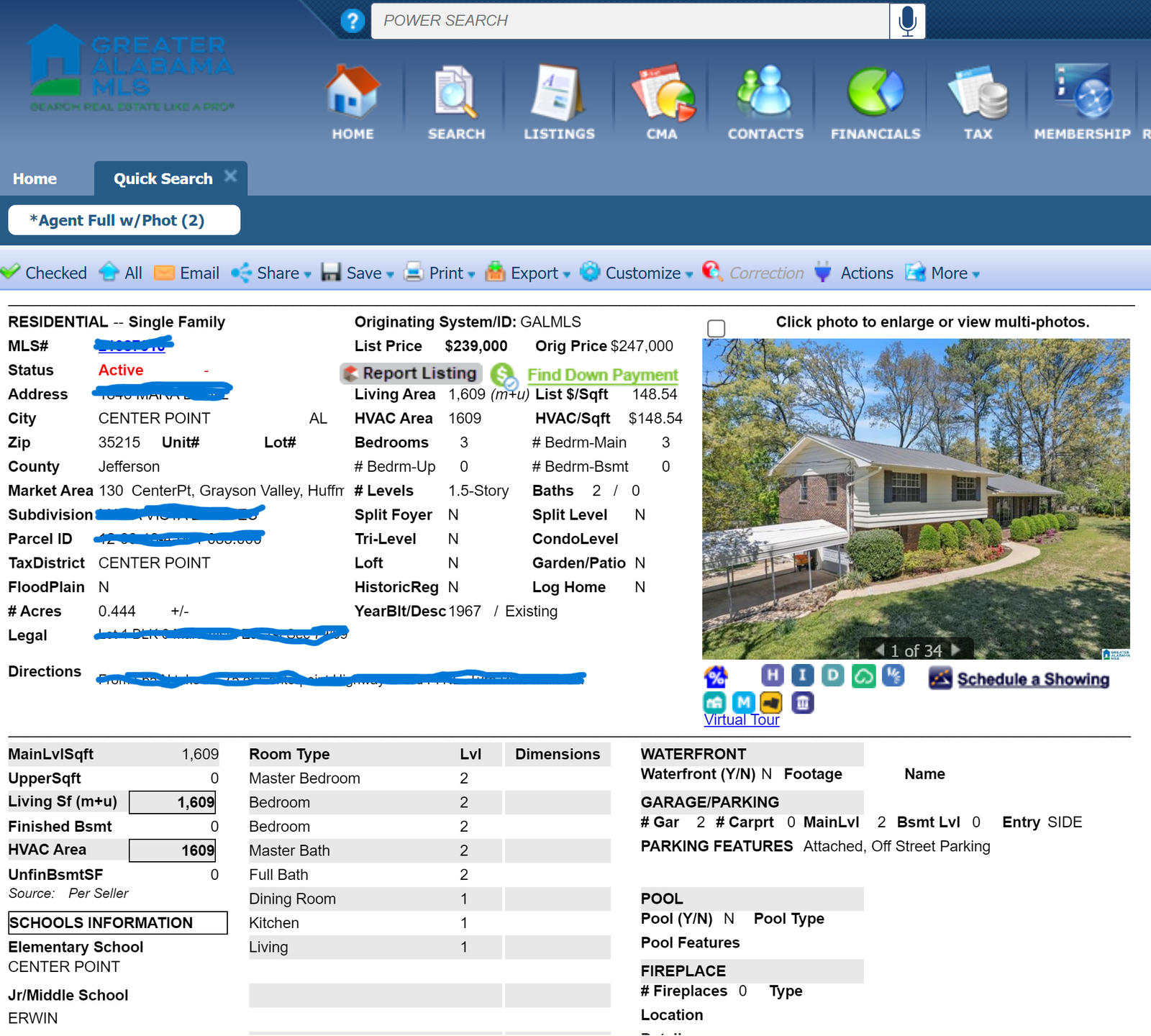

An agent recently contacted me about a fully renovated split-level 3-bedroom, 2-bathroom house with a 2-car garage, listed at $239,000. The renovations were well-executed, and comparable sales in the area support an ARV of $239,000.

This is the second agent to list the property. The first agent listed it for $249,000 on April 10, then dropped it to $239,000. After 49 days without success, the listing was cancelled on May 29.

The current agent listed the property on May 30 for $247,000 but now has a tenant paying $1,800/month with a 2-year lease. The price was then reduced to $239,000 on June 14, but it has been sitting without offers for 67 days.

Yearly Projections:

- $21,600 gross income ($1,800/month)

- $12,000 taxes ($1,000/month)

- $12,000 insurance ($1,000/month)

- $2,160 property management fee

- $21,600 gross income – $26,160 expenses = a negative $4,560 cash flow.

As a real estate broker, I would have explained these numbers to the owner and likely not taken the listing. However, you have an inexperienced agent wanting a listing and an out-of-state investor who panicked and placed a tenant into the property, hoping it would attract investors. The owner didn’t adequately analyze the cash flow with a tenant, focusing instead on achieving a sales price close to the appraised value.

I’ve seen this happen frequently. The most plausible explanation is that the investor is new or inexperienced, went over budget, and is trying to escape a high-interest hard money loan. Refinancing is not an option because the numbers don’t work. And, if he paid all cash for the purchase and renovations, I will bet a steak dinner he ends up holding the property through the lease term.

The owner should never have placed a tenant into the property. He should have stuck to a retail sales strategy exit.