July 8, 2024 | 2.5 Minute Read Time

A Debt Service Coverage Ratio (DSCR) loan is a type of financing used in real estate that focuses on the property’s cash flow rather than the borrower’s personal income.

Here are the key features and aspects of a DSCR loan:

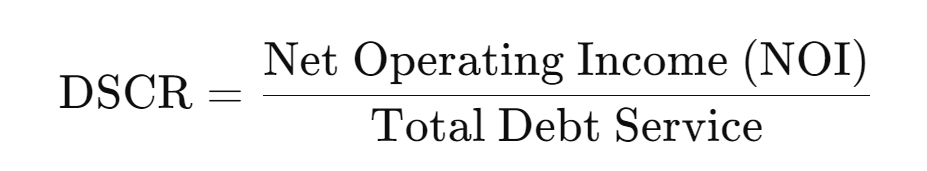

Debt Service Coverage Ratio: The DSCR is a financial metric used to evaluate the ability of an income-producing property to cover its debt obligations. It is calculated by dividing the property’s Net Operating Income (NOI) by its total debt service (the amount needed to cover principal and interest payments on the loan). A DSCR greater than 1 indicates that the property generates sufficient income to cover its debt obligations.

Net Operating Income (NOI): This is the total income generated from the property (such as rent) minus operating expenses (like maintenance, property management fees, and taxes).

Loan Approval: In a DSCR loan, the lender evaluates the loan application primarily based on the DSCR. Typically, lenders require a DSCR of 1.2 or higher, meaning the property must generate 20% more income than the debt service required. This reduces the lender’s risk, as it shows that the property can comfortably cover its debt payments.

Types of Properties: DSCR loans are commonly used for commercial real estate investments, such as turnkey SFR rentals and multi-family properties.

Advantages:

Focus on Property Cash Flow: Since the approval is based on the property’s ability to generate income, it can be easier for investors with multiple properties or those with non-traditional income sources to qualify.

Flexibility: Investors can often finance properties that generate sufficient cash flow even if they have lower personal income or higher debt-to-income ratios.

Disadvantages:

Higher Interest Rates: DSCR loans come with higher interest rates under a corporate entity compared to conventional loans financed under personal names due to the increased risk for the lender.

Strict Cash Flow Requirements: Properties must have strong and consistent income streams to qualify.

DSCR loans are an essential tool for real estate investors looking to finance income-producing properties, focusing on the financial performance of the property itself rather than the borrower’s personal financial situation.

I assist and advise many investors in obtaining DSCR loans for their investment properties. Reach out to me at guru@rei.school if you would like to further discuss.